Bull Market Intact. Q3 Pullback Intact. Bounce Setting Up.

Sorry for the late post. I just returned from Scotland yesterday and I am playing catch up, and one of my bags decided it wanted some time in London before returning to the States. It was a small, but motley crew and an epic trip to the Highlands. Only 1507 pictures taken.

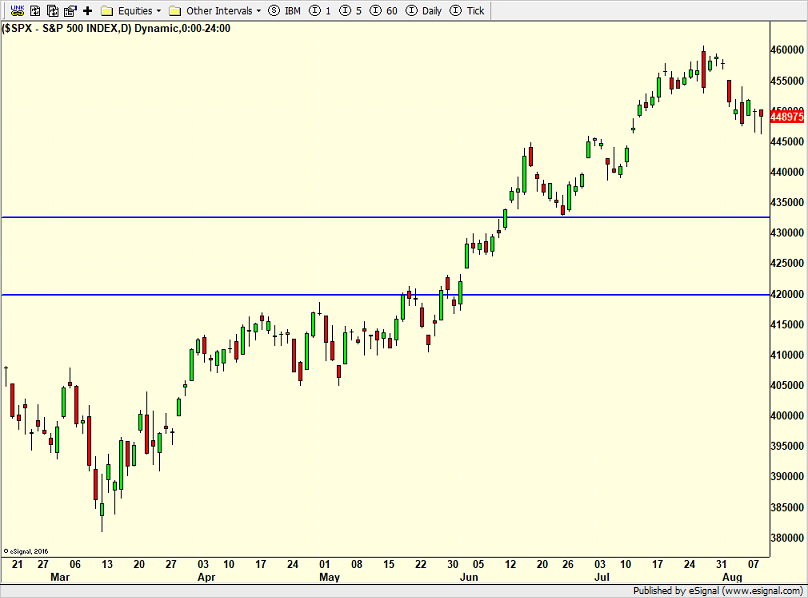

As you know, I have greatly tempered my enthusiasm for stocks over the past week or so. The bull market remains intact. Even this big leg of the rally is pretty much still alive, for now. But as the masses were converting to the bullish side and disavowing or forgetting how bearish they were, I became worried. The market began to look tired. It seemed like it was just waiting for a catalyst or an excuse to decline.

Over the past week we saw second rate rater, Fitch, downgrade the credit of the U.S. And then we had Moody’s downgrade 10 banks. I already laughed at Fitch over their reasoning. With Moody’s I feel like they wanted to do this when the banks sank in March, but didn’t want to be a laughingstock like so many analysts who downgraded then.

You can see the March plunge below and then a nice little recovery since. I do like how the banks are behaving. After stocks get through this pullback, I think banks can rally again and perhaps lead. At a bare minimum I think the index is going to that blue line.

Several have asked if the pullback is over or close. If not, where will it end? I don’t think the decline is over. However, I do think a bounce is setting up right here. It could be for a day or a few days or even longer. But, I think a better buying opportunity for a longer period of time is later in August or Q3. I would think that 4400 is a good first target, but it could be lower. I will continue to take stabs in indices, sectors and stocks but not give positions much room to move against me if I am wrong.

On Monday we sold levered S&P 500. On Tuesday we bought IJK, GDXJ and more ARKK. We sold some XLC.