OUCH Day on Tuesday

Tuesday was an “OUCH” day. The stock market was set up for a bounce and perhaps a multi-day bounce as I wrote on Monday. The bears pulled the rug out and it was a day that hurt the bulls. As you can see at the end of this post we ended up selling a good number of positions as the set ups failed and I was wrong.

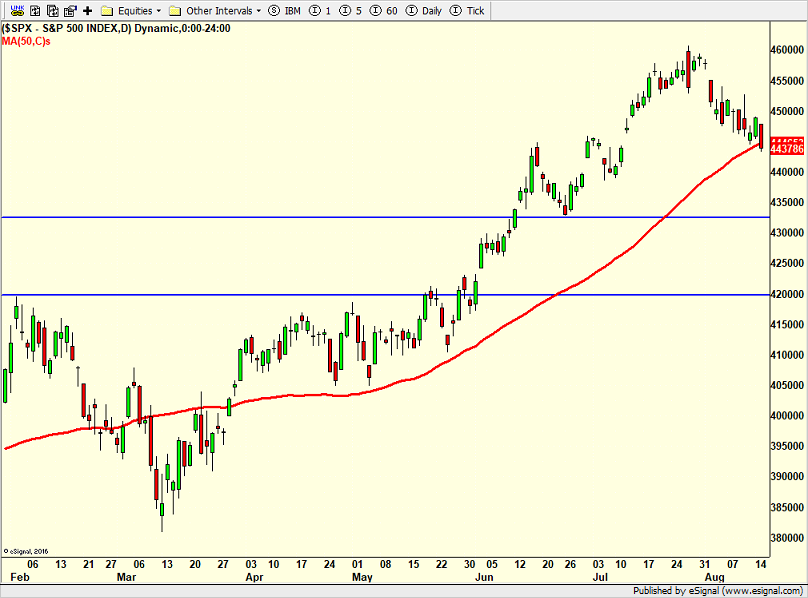

I mentioned before, but it’s important enough to reiterate. A few weeks ago and ever since, I tempered my enthusiasm for stocks and began to expect a pullback. As the pullback began, I offered that I was looking for a mid single digit decline that would be the largest decline the rest of the year and occur in Q3. Along the way there should or would be opportunities to buy weakness and sell strength, but with a tighter leash. That was the plan and it’s still the plan.

The pullback is not over. Stocks should bounce today or tomorrow or Friday. I know. That’s not helpful for the nimble. I said I would become keenly interested if and when the S&P 500 is down 5% from its closing high. That hasn’t happened yet, but we are getting closer. For now, our non-aggressive equity strategies are running much higher levels of cash than normal. And I will continue to prune and plant opportunistically. I certainly expect to be more successful than yesterday, but I take what the market gives me and I don’t overstay my welcome when my overall thesis is for lower prices.

Of note, a group I mentioned the other day as key had an interesting two days. The semis (chart below) were unusually strong on Monday as Nvidia was upgraded on Wall St and that led to the whole group getting some love after a 10% pullback. Closing below 3500 becomes an important line in the sand and is number one on my list to watch.

Let me end with a fun data mining fact which I think is from my friend Rob Hannah at Quantifiable Edges. The first 5 days of August were down for the S&P 500. The next 12 months are up 83% of the time with strong upside and relatively limited downside.

On Monday we bought IWO, JNK, TSM and more ARKK. We sold EMB. On Tuesday we sold SPLV, JNK, QQEW, MCO, ECL, SPYD, RYPMX, PMPIX, some RYDHX and some GDXJ.