Big Gains on Friday – Bell Ringing?

The horrific and barbaric events of the weekend in Israel by Hamas will certainly overshadow the markets’ short-term trends. I was surprised that Israel’s stock market did not close down more than the 7% it did on Sunday. Our market isn’t even indicating a give back of the big gains on Friday. And FYI, the bond market is closed for the federal holiday today.

On Friday the government released employment data for September. Job growth was well beyond expectations, but the unemployment rate rose and wages decelerated. While the bond market fell hard yet again, stocks went from a moderate decline to a strong reversal and surged from mid-morning to the close in grand fashion.

Was that it? Did the bell ring? Is the pullback now totally over?

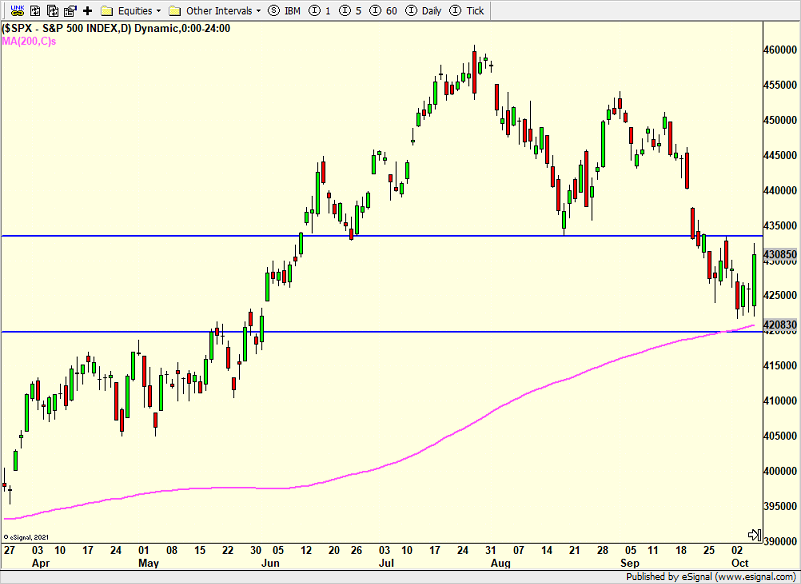

I can’t say that I have high conviction right now. I am just not convinced although I did do some buying. First, the VIX did not spike. And the major stock market indices did not make new lows. And so far, the decline has almost too conveniently held the average price of the last 200 days which is a all too watched level.

Look at the S&P 500 with the 200 day average in pink. While it’s not a necessity I expected the S&P 500 to breach the pink line for at least one to two days.

And the VIX is below. Remember, it usually goes up when stocks go down. We should see a more significant spike above 20, but it is not a necessity.

Below is the 10-Year yield which represents the long-term bond market. Notice that it reversed to the downside after the initial surge on the jobs data. I expect much more on the downside if stocks are going to rally into January like I still think.

Today is a seasonally strong day, meaning that we have a tailwind based on the comeback from Friday. Obviously, global events will always trump seasonal headwinds and tailwinds.

On Friday we bought FVD and more ERX.