More Evidence of The Bottom

As you know the time and price targets for a bottom were met. The window for a bottom opened a few weeks ago and it’s hard to argue that a low has not been seen. The only push back the bears can offer is whether or not it was the bottom for Q4. The bears will say it wasn’t while the bulls will say it was.

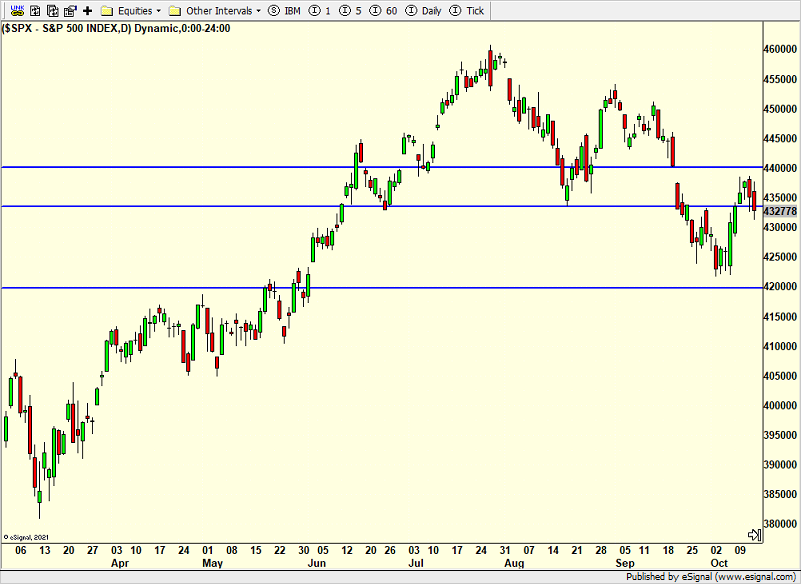

I added a third blue line to the very familiar chart below. It’s highest one around 4400 in the S&P 500. When the S&P 500 closes above that line, the bears will be in trouble, big trouble I will argue. I think that’s the hill they die on in the short-term. Making new highs for 2023 will create a whole different set of problems for the bears, especially if that happens this quarter when so many are focused on year-end performance.

The new week begins without further global escalation in the Mideast. After Friday’s poor showing by the bulls on top of Thursday’s reversal, we need to see some progress to thwart off the weakness. I didn’t do the math, but I keep reading that the NASDAQ 100 has been up something like 14/15 of the last Mondays. I should see what the Friday before looked like.

15% of the S&P 500 report earnings this week so we have a lot to chew on. It would be great to get the S&P 500 above last week’s high to set the stage for a move to 4400. Clearly, we’ll need some good news to do that although we do know that the stock market has rallied in the face of bad news several times this month.

On Friday we bought more levered NDX. We sold JOE, CING and MNDY.