WOWZA

That was some rally on Tuesday! And that was on the heels of a powerful rally off of the lowest levels we saw in October. I have to admit that Tuesday even surprised me a bit. You know my forecast. You know I have been positive on the “risk on” markets, but Tuesday was one of those days where they rip the faces off of the bears. It was an OUCH day. The bulls had plenty of those in 2022, but 2023 has been the opposite.

I read a number of articles from the bears how the “government” manipulated the CPI data to show a plunge in health insurance costs and it was all fake. This ain’t my first rodeo and while I admit to being skeptical of government data at times, I do not believe the government just randomly changes it without disclosure. And by the way, it all smooths out over time. The fall in health insurance was a big head scratcher for sure. I want to learn more about how it’s calculated and if there were any anomalies.

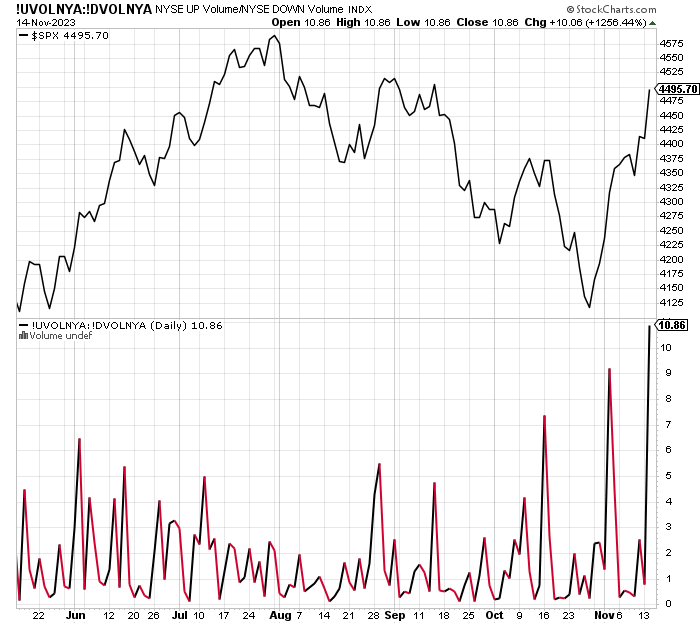

Anyway, guess what? We had yet another day where more than 90% of the volume came in stocks going up versus going down. That’s another very powerful sign for the bulls and another buying stampede as you can see below in the lower chart. WOWZA.

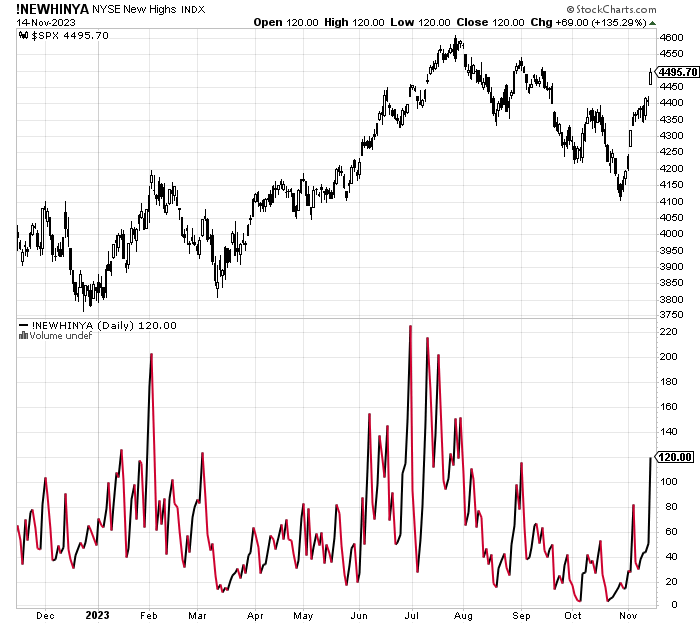

Finally, look at the lower chart below which shows the number of 52-week highs on the NYSE. It has been jumping up which is a good sign for the rally. So when the media or your friends talk about the Super 7 or Elite 8 stocks being the only ones that are rallying, this along with the volume thrusts tell us that’s not the case. The rally is very broad-based and powerful and getting stronger, right on schedule. And as I often say, the most powerful rallies rarely give investors on the sidelines an opportunity to get in. They sit and wait and hope for a deeper pullback that just doesn’t come.

On Monday we bought levered S&P 500 and more BX. We sold EMB. On Tuesday we bought PCY, EMB, PMPIX and more levered NDX. We sold levered S&P 500.