Some Weakness Possible – Volatility At New Lows

I hope you had a terrific Thanksgiving holiday and long weekend if you were able to take Friday off. We hosted as usual, but my mom came over, commandeered the kitchen and did most of the cooking to give my wife a little break. Of course, I did my best to open the wine and watch football. After all, America’s Team was playing on America’s holiday. And winning in grand fashion I might add. Yes, the Dallas Cowboys are great at beating the crummier teams, but end up leaving fans like me with heartbreak come playoff time.

It was also opening day at Mount Snow in Vermont and the “little guy” (now taller than me) and I made our first turns of the season. 8 runs in two hours and we called it quits to watch THE Game at noon on Saturday.

Markets return with one of the weakest seasonal days of the year today. Now, that doesn’t mean that stocks crash or even fall hard. it just means that the odds heavily favor a down day, even by a penny. That’s how seasonals work. And the markets headed into the holiday being overbought, so a pause to refresh or mild 1-2% pullback should be expected.

The S&P 500 is kind of in no man’s land as you can see below. It’s below new highs for 2023 and above the 4400 area that I deemed as important. The best path would be for some kind of pullback or sideways movement for a few weeks and then another big push into January. I am still in the “buy weakness” camp. All-time highs should not be ruled out in Q1 2024.

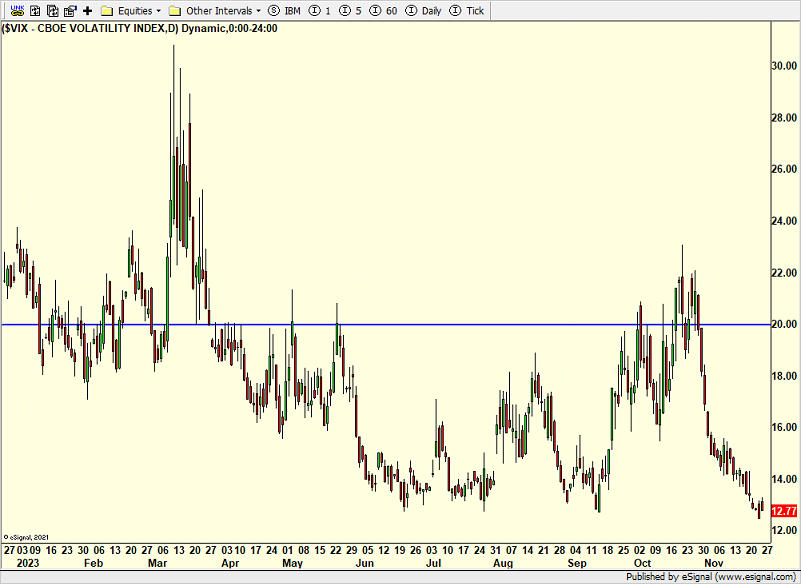

Lots of chatter today about the Volatility Index closing below 13 as if it really meant anything. I heard from the bears that it’s “ominous” and a big “warning” that a plunge is coming. Talk about nonsense backed up by garbage. The VIX always spikes into peaks, but it can be low and scrape along a bottom for weeks, months and quarters. I am old enough to remember it being below 10 for an extended period. High and spiking VIX occurs at bottoms. The opposite is not true.

On Wednesday we bought more levered NDX. We sold levered S&P 500.