Final Day of 2023 Shaping Up To Be Down – Small Caps Have Been a Blockbuster

I have said this all year, but what a fun year it has been. Not only did the markets follow my script fairly well, but it was a blockbuster year for the bulls and investors. I don’t think 2024 will be a mirror image. I am sad to see the calendar turn, but random dates do not impact markets. I continue to formulate my 2024 Fearless Forecast and I look forward to sharing that with you next week.

With markets being so strong, today is actually a seasonally weak day, as counterintuitive as that sounds. I won’t even try to rationalize why people would ring the register and have a taxable event when they can wait until next week. On top of the seasonally weak days across the stock market we also have a weak day for the NASDAQ 100 which has been the strongest index this year.

With the new year starting on Tuesday, we should see at least one big down day next week where the media will scream about everyone taking profits from 2023. If today is down and we get another big down day, I would view it as a short-term buying opportunity.

Regarding all of the studies I have been mentioning this quarter, many of them end next week. The ones that focus on small caps have been blockbusters.

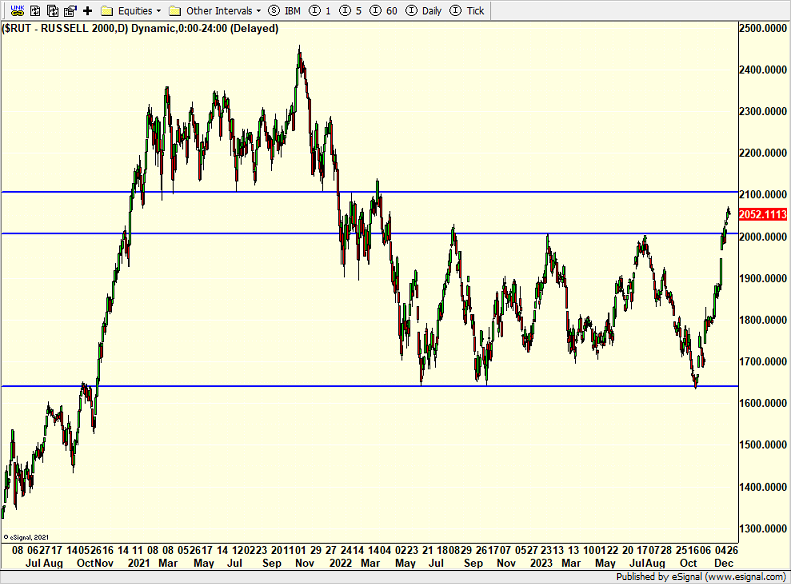

Let’s continue with small caps and the Russell 2000 below over the past few months. On the surface what do you think? Looks pretty powerful. A 25% surge since the October bottom. Not bad, eh? At least for the bulls.

Now let’s zoom out and look at the past year. The 25% rally is still impressive but now we see how important the 2000 level was. The index finally blew through and isn’t up anywhere near what the Dow, S&P 500 or NASDAQ 100 are.

Finally, here is the chart the bears have been hanging their hats on. They have been screaming that the 2000 level would thwart the bulls and then break below 1600. The bears say that the rally is only a bounce in an ongoing bear market.

Well folks, that argument held water for a year. Now, it looks more and more like small cap stocks have been building a foundation as they waited for the Fed to end its rate hike cycle. If that read is correct, the Russell 2000 should head towards 2400 over the coming months, much to the dismay of the bears.

I will have much more to say about 2024 and the year that was in the coming days and weeks. But let me thank you for being a loyal reader. I love my readership in good times and bad. I enjoy the questions and constructive criticism. Keep it coming.

I had hoped to be writing this from Vermont where I typically spend the holidays. We were there for a while, but skiing degraded quickly on Christmas and then the warmth and rain came. While I would have stayed up and enjoyed myself, the family had other thoughts and we all came home. Thinking cold thoughts hasn’t worked this year so I am looking into other means for winter to begin.

Wishing you and your family a Happy, Healthy, Safe, Peaceful and Prosperous 2024!

On Thursday we bought LYV and FUTY.