Don’t Marry Stocks – You Will End in Divorce

As has been the theme all quarter we continue to prune and plant, reducing exposure in those areas that have essentially melted up and adding exposure in areas that have not. In other words, you could say that we have cut back on those handful of super sexy stocks and sectors and rebalanced into the rest of the market. Again, that is how you successfully manage portfolios for the long-term. Otherwise, your portfolio ends up severely overweighted in a small group.

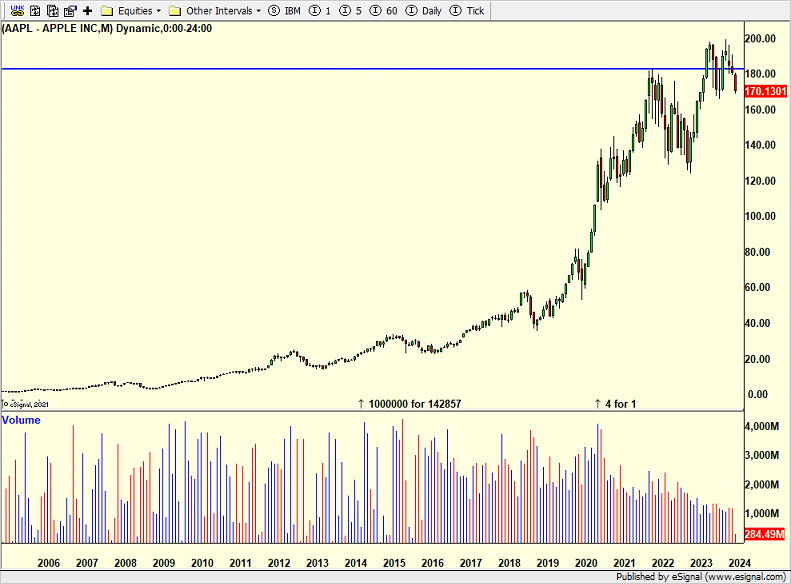

While I am not trying to pick on anyone in particular, I can’t tell you how many times I have heard that folks won’t sell Apple. That’s exactly what I heard about GE in the 1990s and IBM before that. This time is not different. Sorry. And it won’t be for Nvidia either.

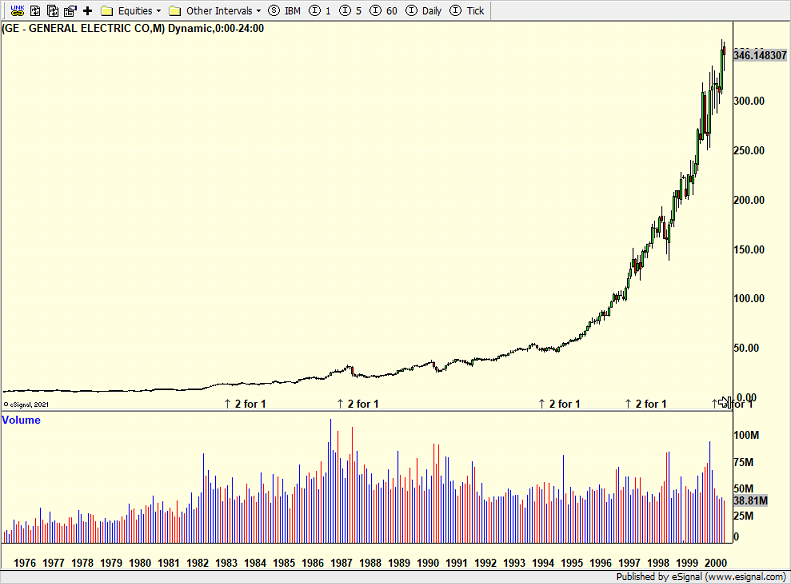

This is what GE looked like in the 1990s when that crook, Jack Welch, ran the company. All I heard was about more stock splits coming and how great the company was. People said there was no other company on earth like GE. It was treason to suggest selling some of the stock. But that’s exactly what I did along the way.

And here is how GE has performed since. Not so good, right? It has been a cataclysmic, unmitigated disaster.

And here’s Apple. Not as good as GE, but I think you get the message. The best investors don’t sit idly with enormous single stock risk. They prune back a bloated position. They plant after a correction. It’s not hard and there’s always something else to own.

The next IBM, GE, Apple etc. is always around the corner. Today it’s Nvidia. Tomorrow it may be a company being created right now in someone’s garage. Please don’t get married to stocks. That always ends in divorce.

On Monday we bought levered S&P 500. We sold some ITB and some levered NDX. On Tuesday we bought more levered NDX. We sold some COIN and some MU.