Stocks Overbought

I hope everyone had a nice Mother’s Day. With the kids home, my mom back from the Sunshine State and my in-laws just down the street, it was great to have everyone over and also celebrate my brother’s double nickel (55) birthday a few days early.

I had my first hands on experience with AI as I listed a brand new Taylor Made driver for sale on eBay. After I entered all the specs, it asked me if I wanted eBay’s AI tool to write the description. I said, “sure”. It was pretty cool and really accurate.

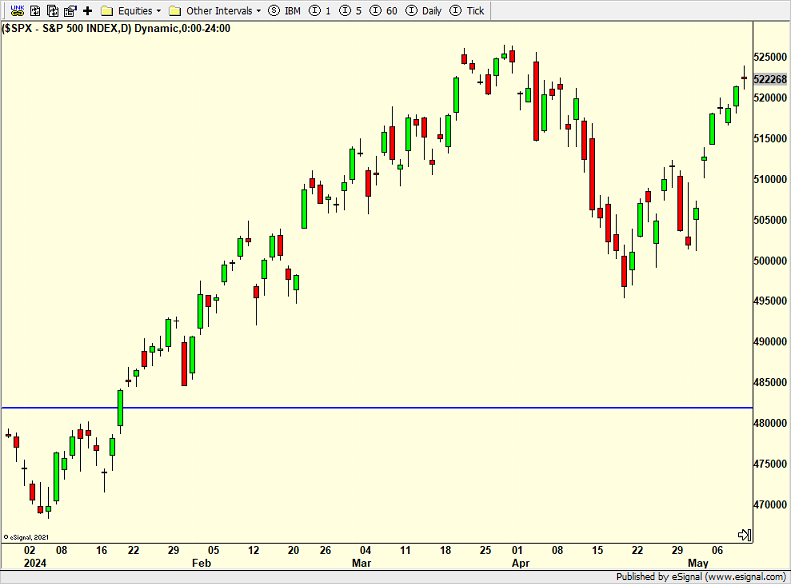

The stock market heads into the new week being overbought. It was been a nice and tidy little run since the late April low. I don’t know whether it pulls back before or after the hugely watched inflation numbers due out this week, but there should be a pause to refresh coming. And that weakness will be buyable just like every other bought of weakness since October 2022 has.

Last week I wrote about the utilities becoming an AI play and how they went from univestable to be clamored for by the masses. And right on cue, Barrons poured more fuel on that fire.

Q1 earnings season has mostly come to a close. There are a handful of big companies left to report like Home Deport and Nvidia. As I reviewed the 40+ stocks we own I non-scientifically noticed that with the stock market at or close to all-time highs, we had an unusual number of misses and blow ups in the portfolio. Nothing actionable and I am not extrapolating, but something I noticed.

On Friday we bought RYDHX and more levered NDX. We sold some Russell 2000 and some levered Russell 2000.