A Pullback Will Come

Stocks continue to creep higher as I discussed the other day. We have the Fed meeting today and tomorrow with the announcement of no rate cut on Wednesday at 2pm. However, the markets will be looking for signs that a cut is coming this fall. We are also the heart of Q2 earnings season and the stock market has been unusually quiet. The mega tech companies are on deck and they usually provide some fireworks.

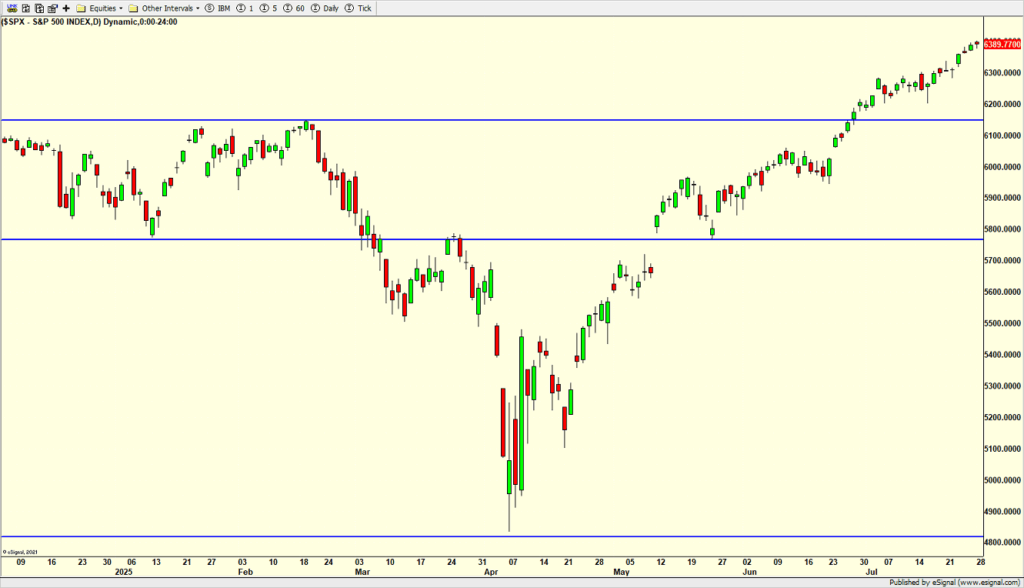

The stock market looks a bit tired, which has been the case for a while. It will be interesting to see how quickly buyers step up on the next 1-2% pullback. I still think that a deeper decline is coming this quarter. Speculating that some weakness this month could see a quick decline to the 6200 area.

Someone asked me how to add money when stocks have rallied almost unabated for more than a month. It’s not easy. And I think you need to be deft. There is nothing wrong with incrementally buying or finding off the beaten path investments. Folks who panic sold in early April keep shaking their head and spinning the geopolitical narrative. All that nonsense of 401Ks becoming 201Ks has certainly subsided, hasn’t it?

On Friday we bought more SHW, FDLO, XLRE and XHB. We sold some QLD. On Monday we sold ITA and LHX.