All Eyes on CPI But Does It Matter?

With the Consumer Price Index due out at 8:30am, that is almost guaranteed to be the talk of the day. As I have been mentioning all year, my thesis is that inflation remains stubbornly elevated with 3% being the new 2%. I have been writing about inflation bottoming and the last few months have certainly proven that. I don’t have strong conviction about this one single number.

When I look at the yield on the 10-Year Treasury, it broke out above 4.35% and then promptly reversed yesterday, a marginally good sign. However, the CPI number trumps all in the short-term. A move to 4.20% would render the breakout null and void and likely lead to stocks to see new highs shortly. That would conflict with my thesis that the stock market peaked in Q1.

The U.S. dollar on the other hand is positioned for more upside.

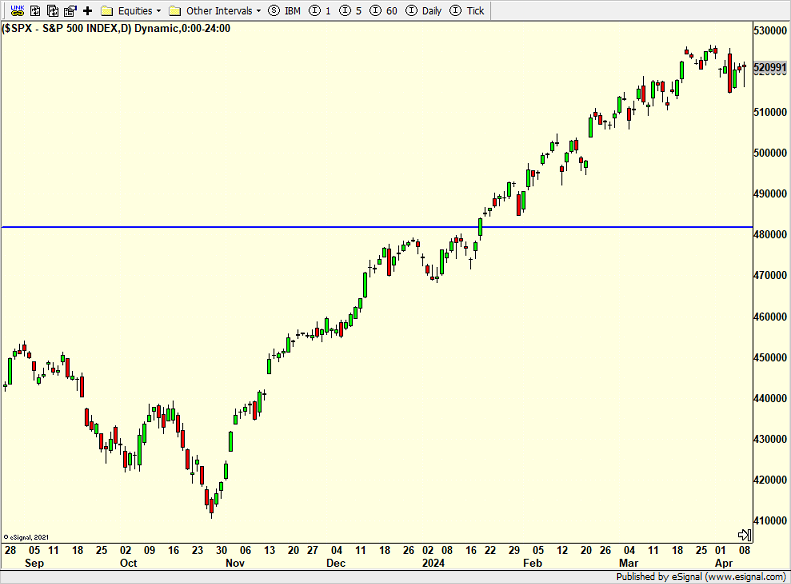

The stock market is still digesting the reversal day from last week and remains in a position to move below last week’s low.