All Signs Point to a Horrifically Wrong Decision by Yellen & the Fed

FINALLY, or YET AGAIN, it’s FOMC statement day. Unlike every meeting since 2007, I do believe the Fed is wrongly going to raise short-term interest rates for the first time since 2006. Since 2008, my thesis has been and continues to be that the Fed should not raise interest rates until the other side of the next recession. This is your “typical” post-financial crisis recovery that’s very uneven. It teases and tantalizes on the upside and frustrates and terrorizes on the downside. Another recession, albeit mild, is coming over the next few years. That’s okay. We’ll get through it. On the other side of it, our economy should get back to trend or average GDP growth, not seen since pre-2008. This could also coincide with Europe getting its fiscal act together after another sovereign debt crisis.

I have heard some pundits use the word “credibility”. The Fed needs to hike rates to either preserve or establish credibility. I am sorry, but that’s idiotic and doesn’t need any further rebuttal. Some believe that an unemployment rate of 5.0% represents “full” or “maximum” employment and that a rate hike is necessary to cool the jobs market. Another reason I totally dismiss as unfounded. How about the labor participation rate at 62.40%, a 38 year low?!?!

From my seat, it looks like an 80% likelihood and the markets are expecting the rate hike. China has stabilized, but is far from fixed. Europe is teetering on recession but that’s been the case. The dollar is well off the highs, but the bull market has at least another 20% left on the upside.

This will be the first rate hike ever with inflation under 1%.

This will be the first rate hike ever with the annual social security COLA at 0%.

This will be the first rate hike ever with wage growth needing to jump 100% to hit the Fed’s target.

This will be the first rate hike ever with industrial production on the verge of recessionary levels.

This will be the first rate hike ever with GDP barely 2%.

This will be the first rate hike ever with inflation expectations close to 0%.

This will be the first rate hike ever with retail sales closer to recession than escape velocity.

This will be the first rate hike ever with non-farm payroll job growth continuing to decelerate.

Where’s the fire?!?!

What’s the hurry???

I could go on and on, but I think you get the picture.This is not a normal first rate hike where the Fed is trying to tamp down inflation and/or worry about an overheating economy. This is simply to move off the 0% emergency level and get going. It’s also the wrong decision.

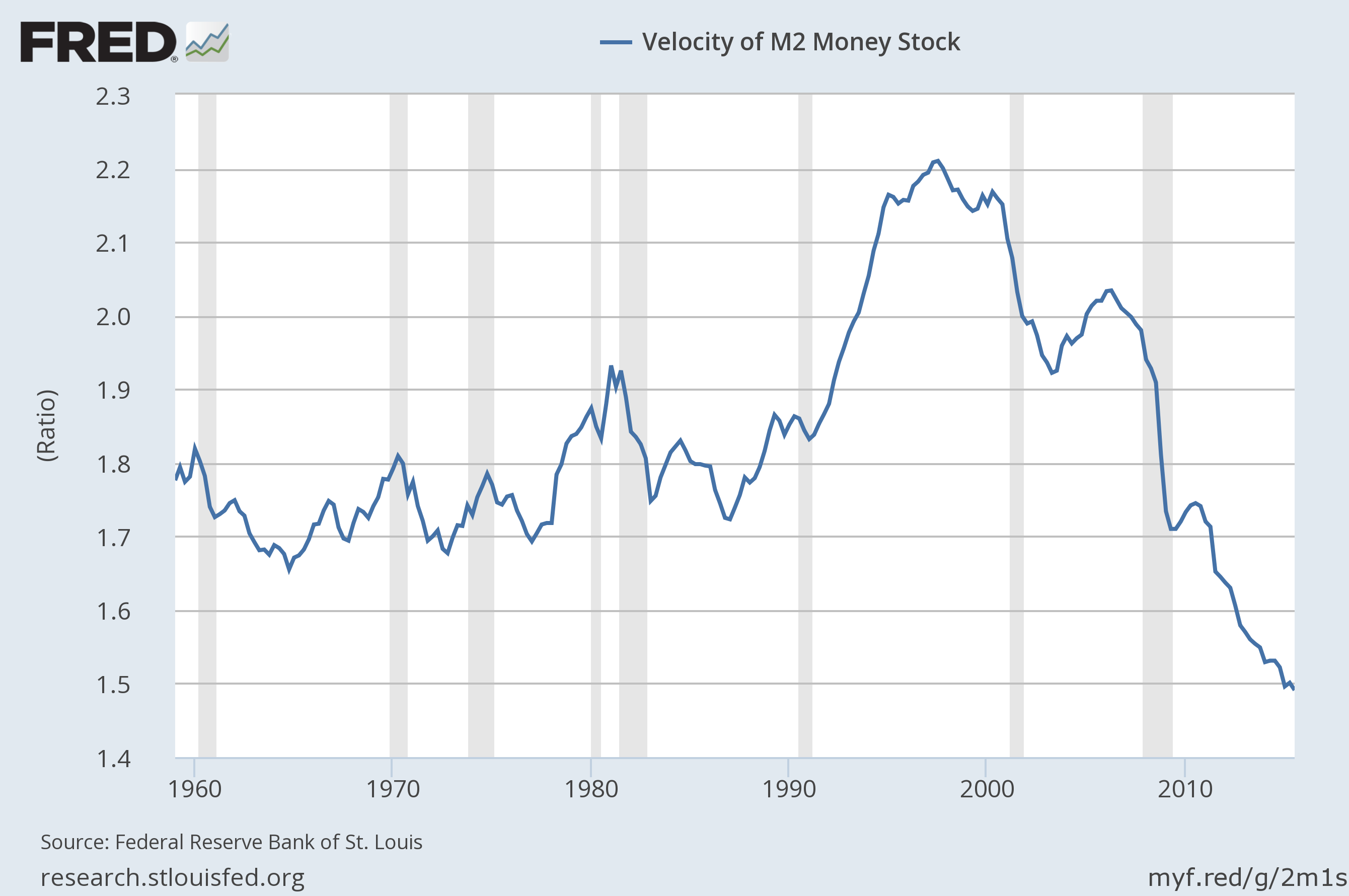

Money velocity, which tells us how often a dollar is turned over during a given period of time, has been in a steady downtrend since 1998 and stands at the lowest level since records were kept. See the chart above. It saw a small rally from 2003 to 2006 which the Fed quickly extinguished with rate hikes. Now they are going to raise rates with this important indicator at all-time lows.

Unfortunately, I do not believe this is a one and done deal for Yellen et al. With the voting members of the FOMC changing substantially in 2016, the Fed will become much more hawkish next year. I forecast a .25% rate hike every quarter next year in March, June, September and December to end 2016 in the 1.375% zone.

Finally, the historical trend for today is to see the major indices trade in a +0.50% to -0.50% range until 2pm est and rally into the close.

If you would like to be notified by email when a new post is made here, please sign up HERE.