All-Time Highs Already? – Semis Boosting Market

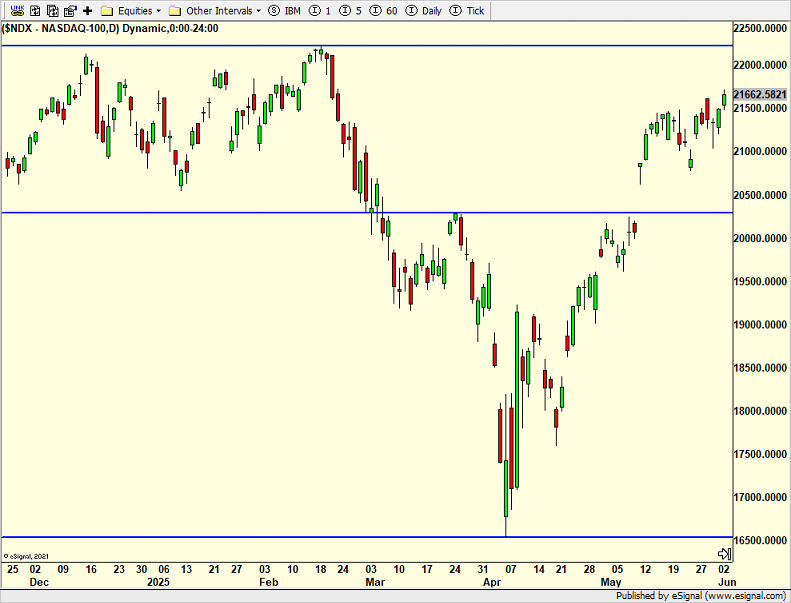

The S&P 500 is now only 3% from all-time highs. Just two months ago the masses were talking about a repeat of the COVID crash or 2008. Few wanted to listen to hugely bullish side of the ledger that I was selling. People laughed when I suggested new highs were coming in late Q4 or early 2026. My timing may be off, but no one can question my bullishness. All the geopolitical nonsense chatter clouded some investors’ thinking into selling assets into the abyss and being left in the fetal position. And while I still do not believe we are going to see a repeat of 2023 or 2024 with 20%+ returns, the rumors of economic collapse have been greatly exaggerated, yet again.

A very under-reported economic stat from last week was the collapse in the trade deficit. That was counterintuitive with all that’s been going on with tariffs. And it may just be an anomaly, but for sure, it is something for those in power to celebrate. The U.S. needs to run a trade deficit with our partners if we want them to buy our debt and for us to remain the world’s reserve currency. However, that deficit doesn’t need to be at or near all-time highs.

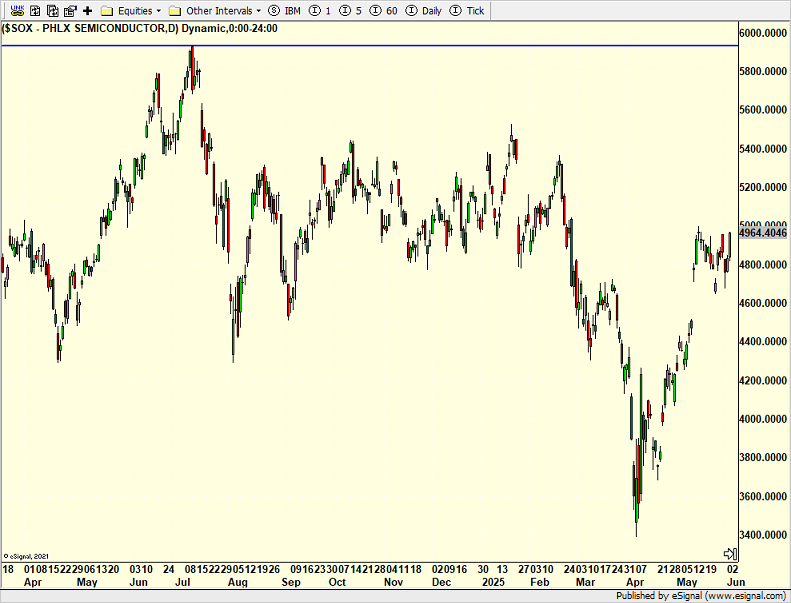

The chart below is that of the semiconductors. With few exceptions, we have largely stayed away since last July. Sometimes we bought innovation, communication services and software. I really wanted to turn positive on semis two months ago as I wrote that the group should bounce strongly. However, the data I follow didn’t suggest it.

Semis have been on fire for 8 weeks in almost melt up fashion. I expect that advance to moderate shortly. If the semis can tack on another few percent this month that should get the NASDAQ 100 back to new highs way ahead of schedule.

On Monday we bought DWAS, more QLD, more MQQQ, more CELH, more UBER and more CVS. We sold CHD.