Analogs To The Dotcom Bubble

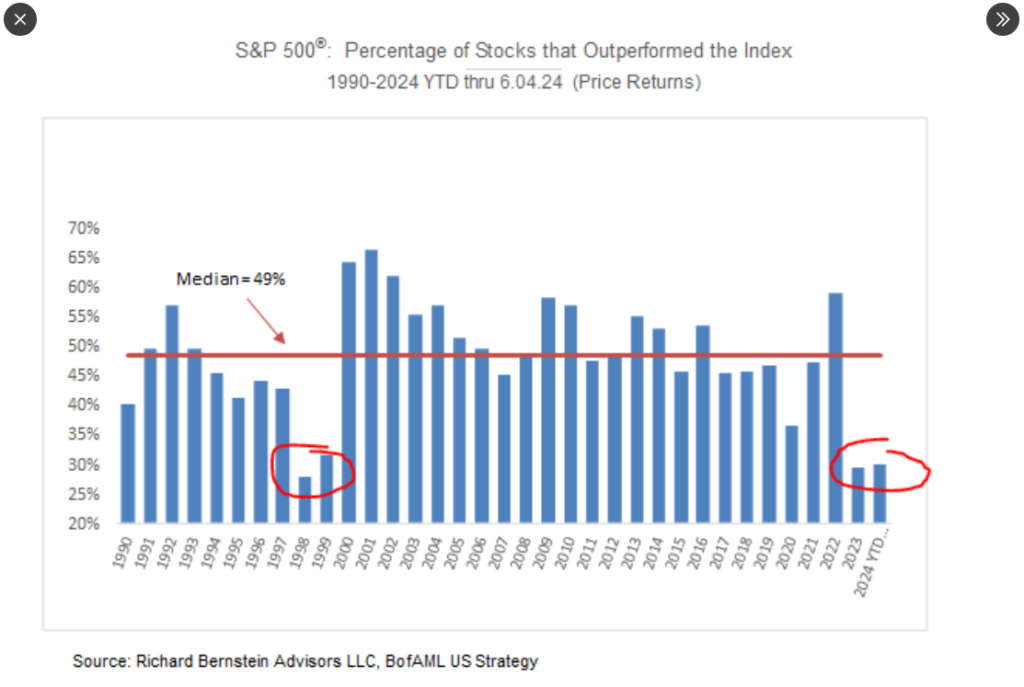

This is going to be a quick blog as I am traveling. I have seen some social media posts and heard some chatter from folks comparing today’s Nvidia-led market to that of the Dotcom Bubble. The most recent Chicken Little chart is below which shows the vast majority of stocks underperforming the S&P 500 index, similar to 1998-1999.

Keep in mind during the Dotcom Bubble, this condition last more than two years. Additionally, market participation is worlds better today than it was back then.

And then there is the new Cisco versus Nvidia analog below which is supposed to scare the heck out of every bull investing. It is interesting, though, that Nvidia is splitting today and analysts are now rationalizing why the stock won’t go down and how all these new buyers will be coming next month.

I do love analogs. They are fun to create and watch unfold. Old timers like me recall when the masses used the Dotcom Bubble bursting to the Japanese stock market post-1989. And when that analog broke down like all of them always do, the bears fit the Dotcom Bubble to the Great Depression. That is, until that one broke down too.

Anyway, today, people are comparing Cisco which was THE stock during the Dotcom Bubble to Nvidia.

I read some other analogs comparing how Cisco was screaming up the list of the most valuable companies and went toe to toe with Microsoft and GE in 1999 and 2000. Today, Nvidia is doing that with Microsoft and Apple.

It’s been a nice run of staying local and getting projects done around the yard, hitting balls and seeing friends. Travel baseball begins on Saturday and until the little guy takes his driving test next month, we are back to being chauffeurs around CT, MA and RI. Thankfully, the weather looks really nice, for now.

On Wednesday we bought levered inverse S&P 500 and more RYFIX. We sold RYKIX. On Thursday we sold some levered NDX.