And Now They’re Off Again

I am rushing to hop on the train to NYC to join my friend, Charles Payne, on Fox Business between 2pm and 3pm so this may be shorter (or not).

In the on again, off again tariff saga, the President reversed course on his 50% European tariff threat over the long weekend. And as you can imagine the pre-market trading is strongly higher by roughly 1.50%, wiping out Friday’s losses and then some. My readers know I have long argued that it is a fool’s errand to use geopolitics in portfolio management. Lots of folks sold on Friday into the weakness fearing a tariff-driven slowdown. The masses sold into the early April mini-crash and have been chasing their tails ever since. Doing anything in investing based on emotion is usually a recipe for disaster. Adding in geopolitics is insane.

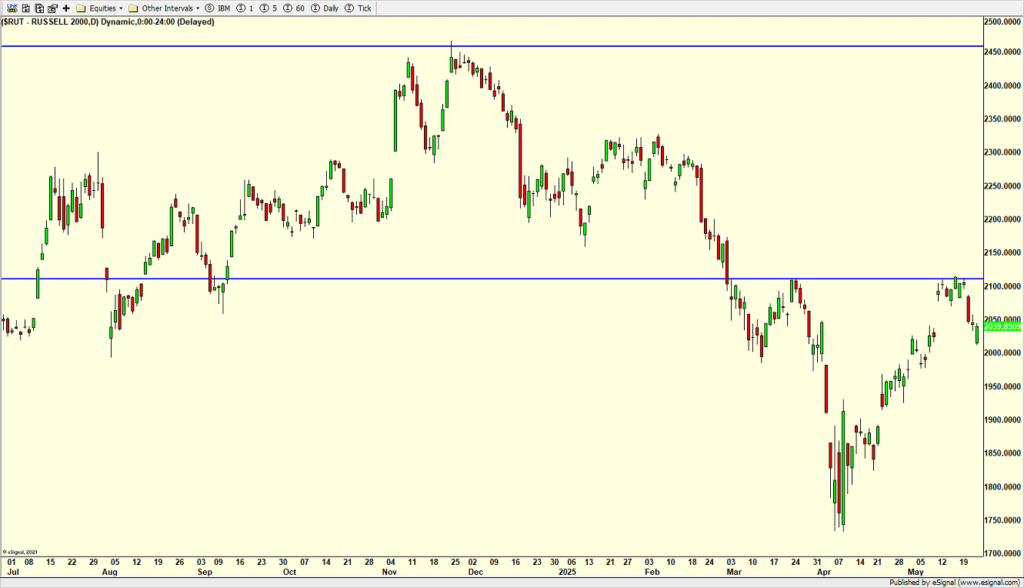

I sometimes get questions about the Russell 2000 Index of small cap companies. For well over a decade those of us who have tried to pivot to small caps have been run over so many times, we have tire marks all over our bodies. And there are some structural reasons to account for this which I won’t go into today.

The small cap index remains down almost 20% from its all-time high. However, it is starting to look like at least a short-term opportunity to lead is before us. It is not a lay up. It is not high conviction, yet. It’s just something that is trying to set up. The chart is below and I will have more on this as conditions warrant.

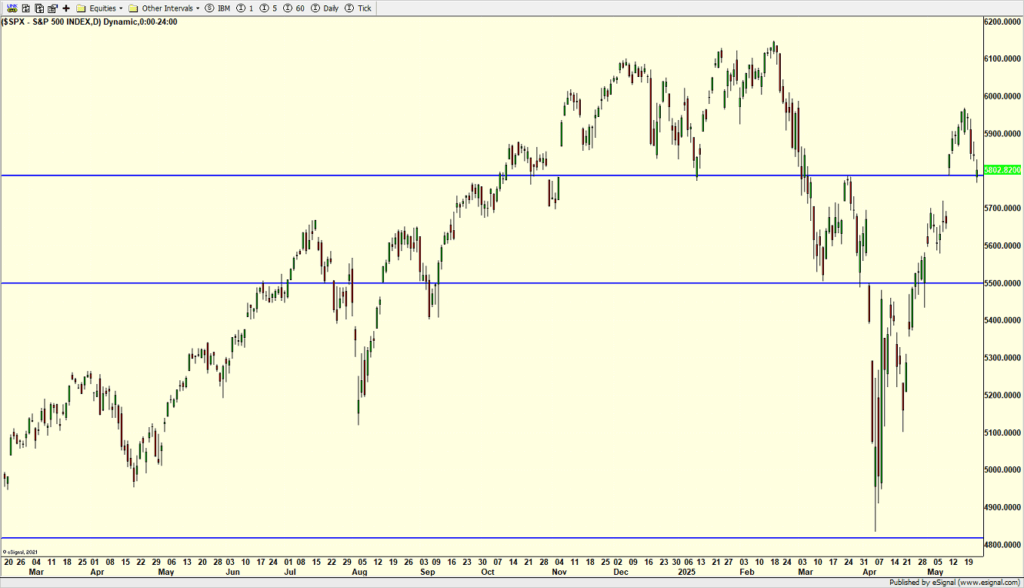

The S&P 500 is below and you can see what a nice and tidy pullback has been seen, slight more shallow than I thought, but healthy nonetheless. Assuming stocks hold their gains and rally, it puts the market into an interesting position where a move to 6000 next month would be absolutely needed to avoid a deeper pullback below 5700. Right now, there is nothing to indicate 6000 will not be achieved. I am just laying out the opposing scenario.