Another Good Day for the Bulls

After a number of short-term victories for the bulls over the past week, the Dow Industrials and Dow Transports scored new all-time highs together, triggering a Dow Theory confirmation or buy signal on Wednesday. While the Dow Industrials were the lone major stock market index to see fresh highs so far, I expect the S&P 500 to follow suit shortly. The S&P 400 and Russell 2000 should not be far behind which would add even more credence to my forecast of limited downside. However, I still do not believe that stocks are ready just yet to blast off on another leg higher. As the NASDAQ 100 repairs itself, I think the stock market remains in a trading range which will eventually be fully resolved to the upside.

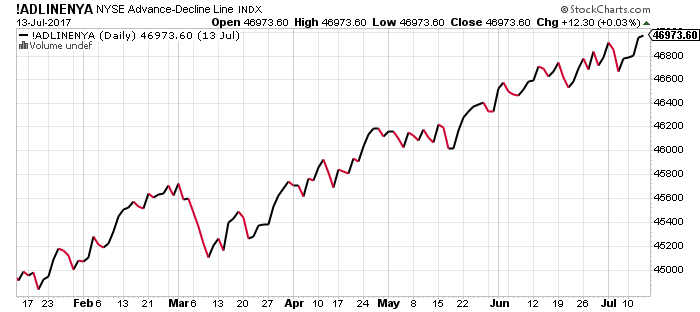

Participation in the rally remains very, very broad and strong no matter what you hear differently from the pundits. These are the same pundits who were negative after BREXIT and the election last year and continue to scream about a major decline or bear market starting. The chart below says it all. The NYSE A/D Line is once again at all-time highs. While it’s not 100% perfect, this indicator rarely looks so strong as a bull market is ending. When I say “rarely”, I believe it has only failed once in the modern era. In any case, with high yield bonds stepping up again and the other evidence I continue to point out, buying weakness is the correct strategy until proven otherwise.

If you would like to be notified by email when a new post is made here, please sign up HERE