Another Set Up For The Bulls

As I discussed this week, the stock market often sees a very mild seasonal soft patch or headwind in mid-December that ends plus or minus five days around options expiration which is this Friday. I was looking for at least one more move lower to increase exposure and that came over the last two days. As always, you can see what we bought and sold at the bottom.

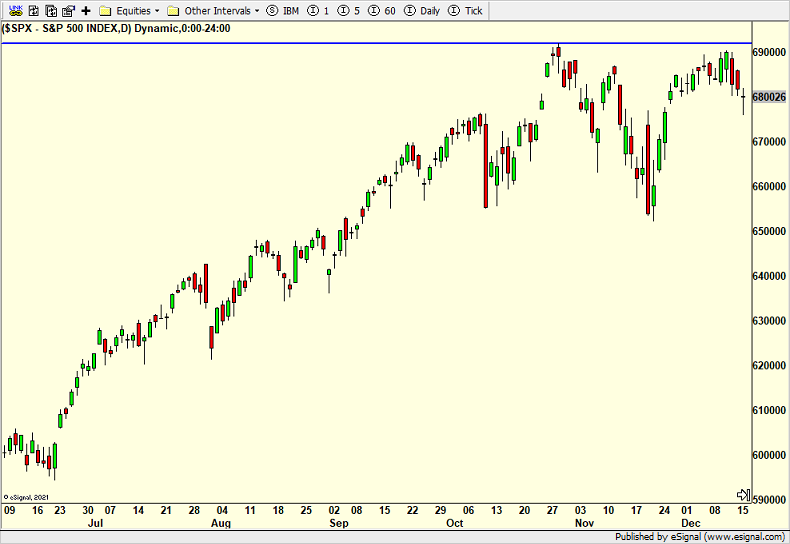

The S&P 500 is below and it is setting up for a rally to new highs. I do not want to see it close below Tuesday’s low. That would be disappointing.

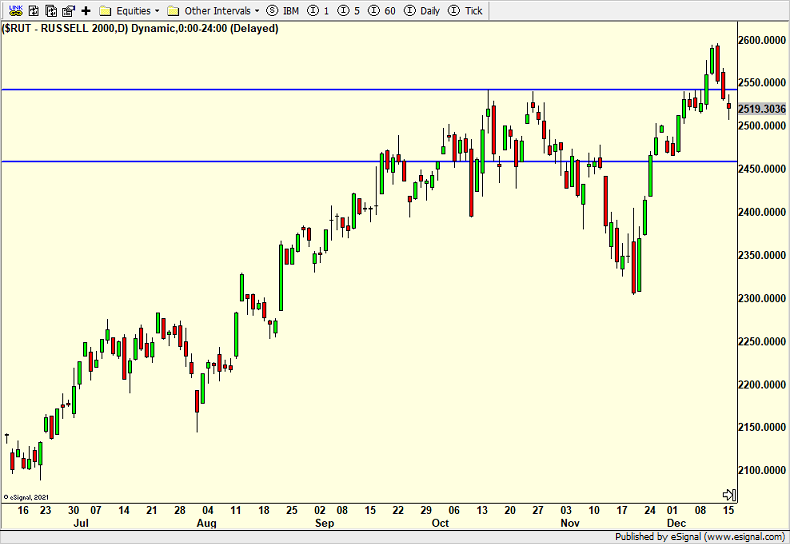

The Russell 2000 Index is next. I have been positively disposed to small caps relative to the other indices since April and remain that way. There are plenty of small cap ETFs to own and we own a bunch. I am also looking for a move to new highs sooner than later.

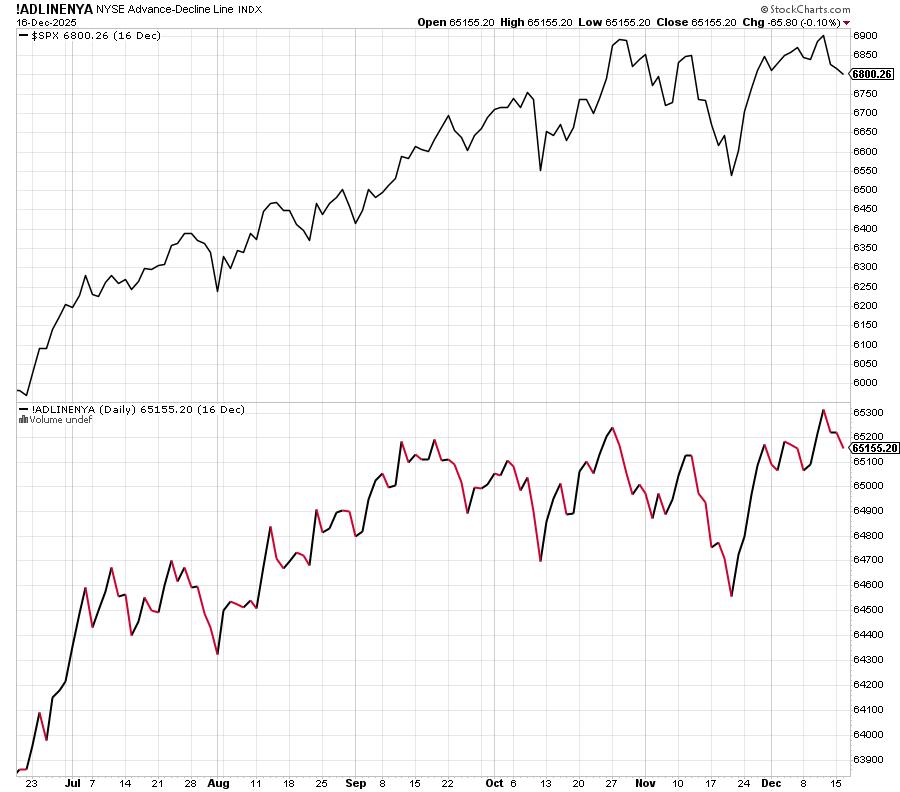

Finally, the New York Stock Exchange Advance/Decline Line just hit an all-time high last week. While that says about today, this week or into 2026, it does tell us that the market is mostly insulated from a large decline and bear market. Don’t ignore this. It helps shape the outlook for the first half of 2026 which is bullish.

On Monday we bought PCY, EMB and LULU. On Tuesday we bought SMH, more TQQQ, more AGG and more MQQQ, We sold XLRE.