Another U.S. Debt Downgrade – Buy Weakness

The big news of the day is actually what came on Friday right after 4pm. Credit rater Moody’s downgraded the U.S. from AAA to Aa1 in a mostly symbolic move. It is also more than 13 years after S&P began the downgrade process in August 2011. In short, while the move was long overdue and correct, it is stale and pretty much meaningless. Everyone and their dog knows our fiscal path is not sustainable. Politicians are 100% to blame, on both sides of the aisle.

However, as long as the U.S. dollar remains the world’s reserve currency, it almost doesn’t matter. That penultimate privilege isn’t guaranteed and will likely go away at some point in our lives. Then it becomes super serious and will not end well. Inflating our way out is likely the only course of action.

There is little political will to fix our fiscal problems. Tax brackets need to be simplified to three, a low, medium and high. And taxes need to go up as painful as that it for me to type. A VAT needs to be considered which would solely be earmarked for debt service. And then spending needs to be cut. All bad and painful choices which no politician could survive. And by the way, if the U.S. does this stuff, then the economy looks more like Europe for a decade or so. Slow and stodgy, never really surging, always closer to recession.

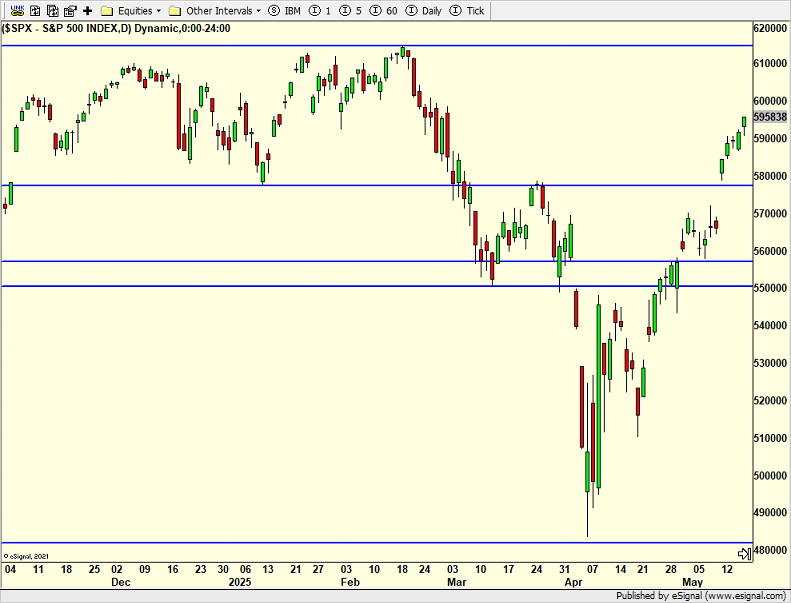

Back to the markets. In 2011, stocks plummeted more than 6% on the debt downgrade. Today, we are looking at 1%. I would still use weakness as buying opportunity, at least in the short-term.

When I look at the chart below, I want to remove the period from April 3 to April 24. That was the tariff tantrum plunge and rebound rally. Everything below 5500. That makes things much more understandable and easier to navigate. That would set up a move to new highs sooner than I thought in Q3. For now, the range on the S&P 500 looks to be 5700-6100.

On Friday we bought FMAY, QLD, more MQQQ and more UWM. We sold IWM.