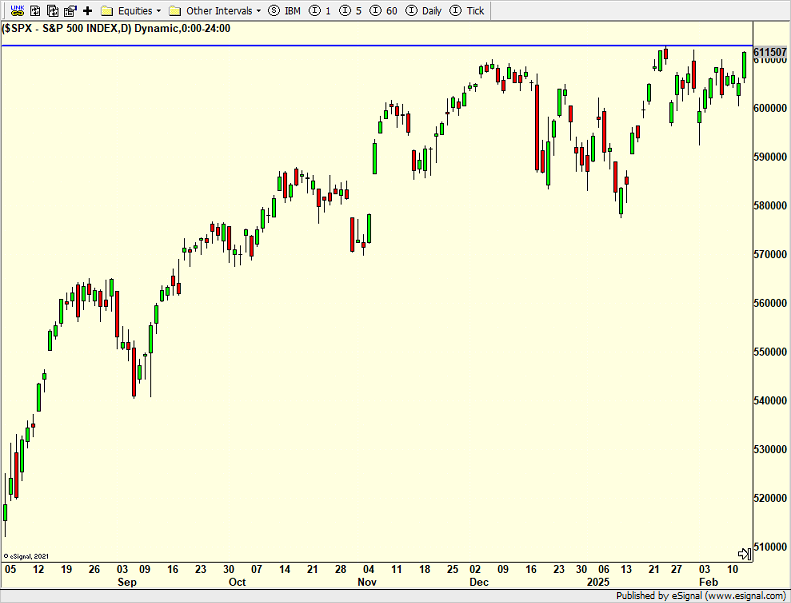

Are All-Time Highs Really Here?!?!

It didn’t feel easy, but the S&P 500 got back to the old highs on Thursday and within a whisker of closing at fresh, all-time highs. It looks like there should be more upside coming with a possible 1-2% spurt higher. Interestingly, the market has ignored the constant barrage of tariffs and DeepSeek and DOGE. Remember what I write. It’s not what the news is, but how markets react.

Markets will do what they want, especially when the news doesn’t impact economic growth and earnings. I have long written that too many people are worried about noise over substance and politics over policy. Obsessing over the news is among the worst mistakes investors can make.

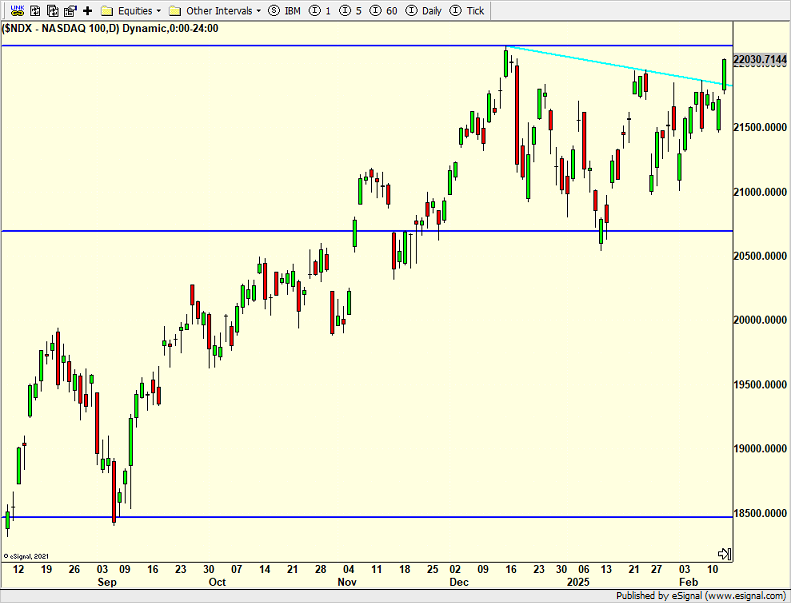

The NASDAQ 100 is basically in the same position as the S&P 500 although it is positioned for more upside if and when it clears that horizontal, blue line at the old highs.

I know these comments will generate questions about buying more in the coming days. As I have written about for the last month, I am viewing a run to new highs as more of a selling opportunity, reduce risk and exposure than I am about going full steam ahead for the bulls. I can’t tell you how our models will react and what we will do, but they are not acting in concert. As always, we will follow them one by one. And yes, sometimes we see models taking opposite positions in the short-term.