Bank Failure, Bank Runs and Images of 2008

As I mentioned on Friday to those who receive our regular blog updates, markets had two giant pieces of news to digest. First, Silicon Valley Bank (SIVB) was put into receivership by the FDIC and then we had the February employment report. I thought I was going to spend this post on the latter as it’s the biggest economic report of the month and would offer clues on what the Fed would be doing next week when they meet again.

Lots to cover. Markets very volatile.

Let’s be crystal clear on SIVB. While it dominated the news all weekend and caused all kinds of repressed feelings from 2008, the news about the bank was out on Friday during market hours. And there were rumors floating around on Thursday as the bank realized it needed capital and could not raise it in the open market.

Silicon Valley Bank was guilty like so many others when a crisis hits. Previous decisions from months and years ago led to their crisis. Management was always hailed as “cutting edge” and “industry leading”. They built the bank into the 16th largest in the country and increased its assets more than 50% since 2019, being the go to bank for tech start ups as well as being fully entrenched in the cryptocurrency space. I can feel people shaking their heads and furrowing their eyebrows.

Like we saw in 2008 with Bear and then Lehman, risk happens very slowly and then seemingly soars overnight.

THIS IS NOT 2008, something I wrote countless times in 2022. SIVB is not a major money center bank. While it will go down as the second largest bank failure in history, it is more of an outlier than at the center. 14 months the banking industry had too much capital. That’s not the issue. SIVB made bad bets in a rising interest rate environment and also got hung up in the crypto world.

The FDIC took over the bank and placed it in receivership. Bids are being accepted to buy the bank for pennies on the dollar. In the meantime the Fed is essentially backstopping depositors beyond the $250,000 in “normal” times. 95% of SIVB’s depositors were uninsured, meaning beyond $250,000. That’s one reason the Fed stepped in. The little guy and gal wasn’t going to be hurt. The Fed also wanted to prevent bank runs at other similarly sized and smaller banks around the country.

Interestingly, executives at Silicon Valley Bank recently sold millions of dollars in stock. They claim they had no idea of impending doom. It doesn’t look that way, but who am I to know. I heard that bonuses were also just paid out for 2022. The optics are not good and I expect enough public pressure to force certain clawbacks or monies to be given back.

Also of note, former Congressional banking chair, Barney Frank of Dodd-Frank legislation fame, endorsed changes to his groundbreaking bill in 2018 so that midsize banks like SIVB would not need to undergo rigorous stress tests like the major money center banks. Oh, and Barney is on the board of Signature Bank which was abruptly closed over the weekend after bad crypto bets took down the bank.

If you think like I do, lots of things smell rotten and disgusting.

The Fed is holding an emergency meeting today at 11:30am. They should have done this over the weekend. We know that the Fed usually raises interest rates until something breaks. This isn’t the first break, but SIVB is the largest and most significant. While the Fed likely hikes by another 1/4% next week, the end of the hike cycle is upon us. I think 1/2% is off the table and should be.

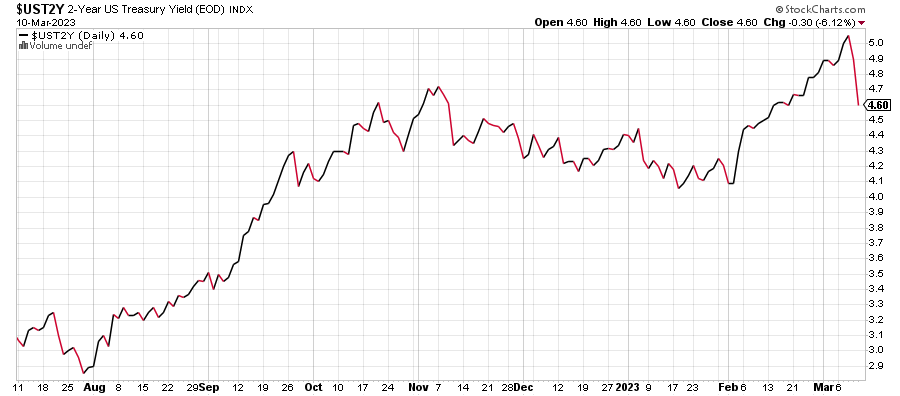

The 2-Year Note yield below collapsed last week. It was a huge move for that market as stress hit the system. Longer duration bonds also saw yields sink. The Fed sees that. Now we keenly watch the difference between short and long-term rates, also known as the yield curve.

As I wrap up in the middle of the night eastern time we still do not have a buyer for SIVB but pre-market action shows a 1-2% rally. We will see if it holds. My guess is it will for now, but the final low is still in front of us. The stock market traded poorly last week, something I wrote about and did not see coming until Thursday.

But all I heard and read over the weekend was fear and panic about contagion and bank runs and 2008. If you’re in the business and didn’t see the news out during the day on Friday then you shouldn’t be in the business. I couldn’t believe the horrible advice I was reading, screaming that people should remove all cash from the system. Just pure and utter nonsense. While I am no fan of the Fed they definitely learned from 2008 and immediately backstopped the depositors of SIVB. I sense that FDIC insurance will be examined and raised again shortly.

On Friday we bought more KBE and levered NDX.