Banks Selling the News. Transport Close By

Earnings season is now in full swing which means that every morning. pre-market, you will find a slew of companies reporting as well as offering guidance or forecasts about the future. That creates a much higher level of single stock and sometimes single sector overnight risk. Right now, the major banks are reporting, after experiencing a near vertical ascent into Q3 quarter end.

The last time I wrote a specific article about the banking sector, it had just touched a three-month low and I offered a very binary outcome. Either it was going to rally strongly to new highs or collapse. Unfortunately and uncharacteristically for me, I didn’t have strong conviction which would be the ultimate outcome.

As you can see above, banks followed the super bullish scenario (line in green) almost perfectly and scored new highs right before earnings season began. On the surface, the average investor would probably become very excited about this development. However, with more than a 10% run before earnings season, I argue that good earnings are expected and already priced into the sector. In other words, investors bought the rumor of good earnings and selling the news. As such, banks would need to really blow out earnings on the upside to keep momentum going which I do not think is likely.

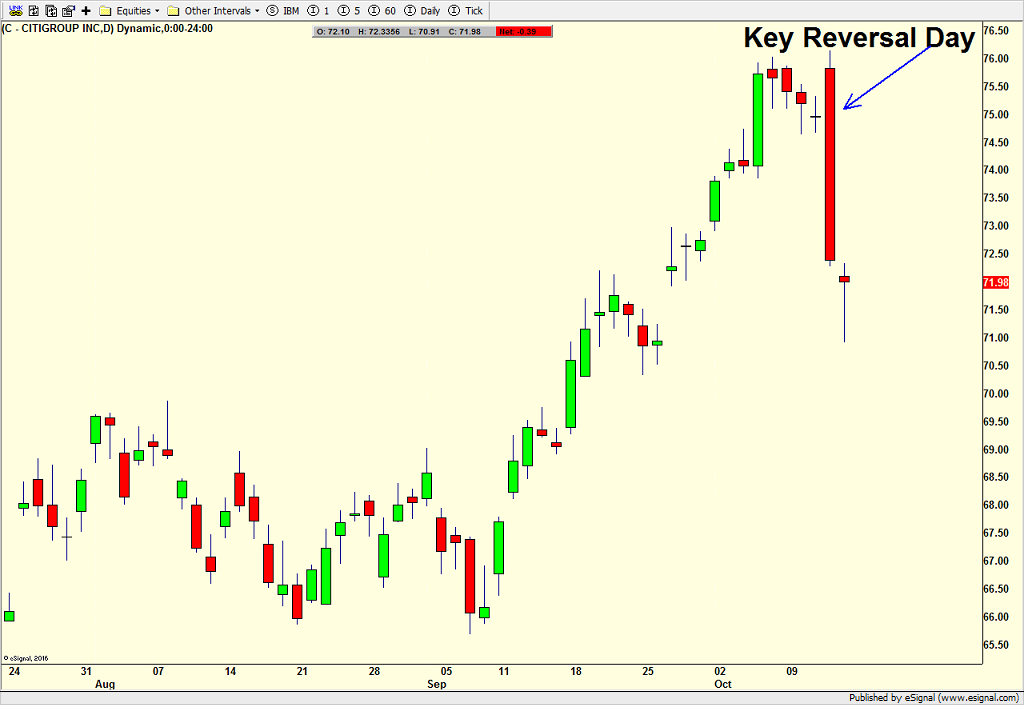

Both JP Morgan and Citigroup reported earnings on Thursday morning. While they both beat expectations by 11 and 10 cents respectively, both stocks closed lower in what technical analysts sometimes refer to as a key reversal day, where a new high is seen and they immediately rejected. Then the close is lower than the previous day’s low. It looks like a long, red stick as you can see below for Citigroup and it has negative implications.

I bring up the banks and reactions to earnings as it shows a tired banking sector. Should banks see a soft patch, that would likely translate into a cessation of the overall stock market’s rally, if not outright, short-term, modest pullback and I have discussing for October. Again, I do not see anything meaningful or long lasting on the downside, just a short-term bout of mild weakness.

Finally, although semis continue to make new high after new high, the transports are seeing somewhat of a reversal as I type this, scoring a fresh high this morning and weakening all day. At the same time, treasury bonds have been quietly rallying along with the defensive sectors, showing that “risk off” is now showing at least a little merit.

If you would like to be notified by email when a new post is made here, please sign up HERE