Barrage of Bad News – Looking for Volatility to Spike

I can always find things that concern me in the markets just as easily as things that are sanguine. Lately, it’s bothered me that the bottom on September 30th came on the screws of the low for the day, week, month and quarter. I couldn’t find a single comparable low and that’s why I thought those price levels had to be breached before the stock market could bottom.

So far, the S&P 500 and NASDAQ 100 have cooperated and cleaned out those lows, but the others have not. We will see if it matters. With prices undercutting a low, I would have expected price to react, meaning a strong and quick acceleration in one or both directions. That hasn’t happened yet and it needs to before a meaningful bottom can be in place. In other words, we need to see volatility spike and for some reason it has not.

With that said, nothing has changed in my thesis that the markets are going to find a meaningful, if not major, low in Q4 with an eye towards October. Recall that incredible bottoms were seen in midterm election years of 2018, 2010, 2002, 1998, 1994, 1990, 1982 and 1974 with most being in Q4 and the majority in October.

The news is dreadful. It’s a constant barrage of bad news. But remember, real bottoms are only made in the face of a very negative backdrop. You don’t see unicorns and rainbows at lows.

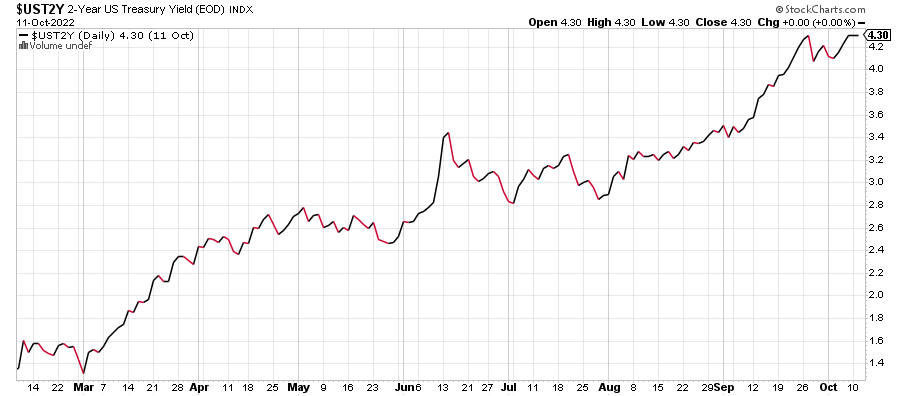

And the 2-Year Note absolutely must roll over to the downside. It has remained stubbornly high. This is as key as anything else to watch right now.

On Monday we bought levered S&P 500 and more levered NDX. On Tuesday we bought SLX, TAN and more IJK. We sold SDS and PCY.