Bears Are Wrong – Yet Again

As I finish this post, the government just released the Consumer Price Index (CPI) and it came in a touch cooler than expected across the board. Inflation continues to moderate as has been my thesis for a year. While it is not getting back to the Fed’s arbitrary long-term target of 2%, it should still slowly meander to some new normal level below 4%. And yes, this takes more pressure off the Fed to raise rates higher for longer. I believe they are done with rate hikes in May.

If the markets deliver one of those huge up openings, I would not mind booking some gains to replant later. And that has absolutely nothing to do with my bullish stance. It’s just good risk management. The leading NASDAQ 100 looks a tad tired. It could mildly pullback or go sideways for a week or so.

Except for a few pauses to refresh I have stayed steadfastly positive all year and dating back to September. And that’s the way I remain today. It’s amazing how many investors spin narratives rather than watch market action. My readers know this, but the masses apparently remain clueless. It’s not what the news is, but rather how markets react. I can’t tell you how many times I hear or read “BUT BUT BUT” when good things happen in the markets. Recession. Inverted yield curve. Bank failures. Russia. China. Inflation. Fed. All reasons to be negative.

Just like with most bull markets, the masses hate and disavow until at least half of the rally is over. The naysayers just keep pushing back their timeline. Morgan Stanley’s high profile strategist, Mike Wilson, turned strongly negative in April 2021 and has basically stayed that way ever since. Earlier this year he stated that if stocks did not roll over by the end of Q1 he would admit he was wrong and embrace the rally. As March wore on, Wilson disavowed his prior claim and doubled down on stocks collapsing to below the bear market lows. It’s much easier to make “calls” and write research than manage portfolios.

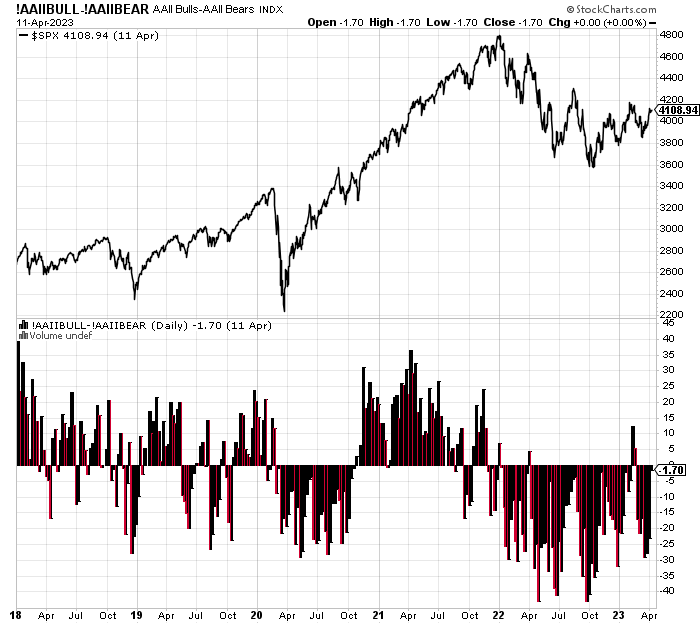

In the lower chart below, almost every single week there have been more bears than bulls among individual investors from the AAII survey.

Remember how stocks started to soar at the end of March 2020 when COVID was just really beginning in the U.S.? And as the market rallied week after week and month after month most investors said it wouldn’t last or it was manipulated or people weren’t understanding what was happening. In the end, and as usual, the masses were the only ones not understanding or denying reality. And many of those naysayers did not embrace the new bull market until 2021 when it was halfway over.

After the 2008 financial crisis it was even worse. Most who ended up selling did so later in 2008. And while the major indices didn’t bottom until March 2009 the masses hated and disavowed the new bull market all the way until 2013. They missed out on 2009, 2010, and 2012. 2011 was a flat year. Investors get scarred positively and negatively but the latter is very long-lasting and damaging.

People ask me all the time if recession is coming. That’s one of the few guarantees I know. The next recession is definitely coming. And the data point to later in 2023 or the first half of 2024. So how did I forecast a big year for stocks, bonds, gold and crypto? It’s because narratives don’t work in investing. The data pointed to 2023 being good for investors. How we reconcile recession will come later. It is certainly possible that some or all of the 2022 decline was pricing in recession. And it’s still possible but not probable that the Fed engineers the elusive soft landing. But in the end, if and when the data change, I will change.

In Monday’s A Powerful Indicator Just Lit Up – Not to Be Ignored, I left out that the downside over the coming 6 & 12 months after a Zweig Breadth Thurst never hit 10%.

On Monday we bought ITB, more levered Russell 2000 and levered Dow. We sold PCY. On Tuesday we bought PFNNX. We sold EMB.