Bears Chew On News – Bulls On Data – Dow 50K & More

After January’s options expiration last Friday, we have a mild seasonally weak patch over the coming four days. Last week, we saw all-time highs in all indices except for the NASDAQ 100 where the super sexy and formerly popular AI stocks reside. Don’t worry. I expect that index to see new highs before long. And my longstanding target of Dow 50,000 remains in sight for this quarter where I expect the pundits to come out of the woodwork with revisionist claims that they called it ages ago.

We have more tariff nonsense in the news over the weekend. Don’t get sucked in to the media’s obsession. It’s not a big deal. Stocks need a breather and the latest distraction will provide that. Since I writing this on Sunday without knowing where Europe is trading, I am guessing stocks could open 1-2% lower. I would be very surprised if it was more. Bears would be so disappointed it was less. Gold and silver should spike on the latest tariff turn. I am a seller on strength.

Could the market pull back a few percent. Sure. It could happen in a single day although I don’t think that’s the case. Could it decline 5%? Sure, but that would be the outer envelope of what I can see right here. And Greenland as a few asked? Irrelevant although the Greenlanders should determine their fate. If they want to be part of Denmark, so be it. If not, so be it.

Focus on the data. GDP 4.3%. Inflation at its lowest level in five years. Earnings surging. Fed to cut more this year. Quantitative easing light is back. Deregulation and tax rebates from the One Big Beautiful Bill are juicing corporations and the consumer.

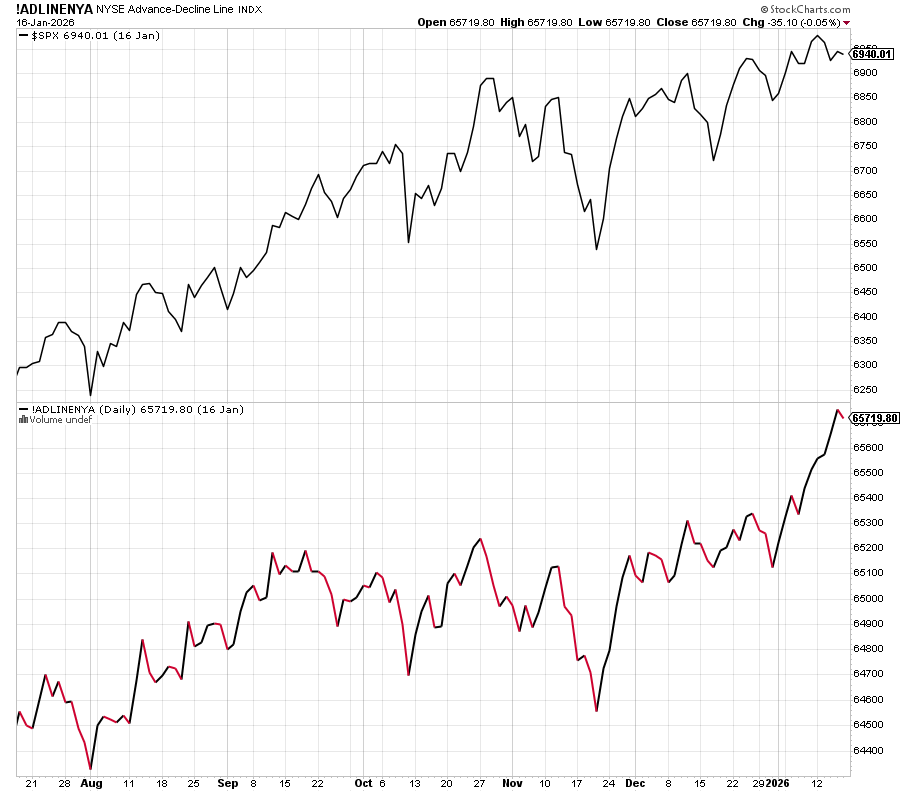

Look at the lower chart below. That measures participation in the rally. Simply put, it has surged. That says nothing about the next week or two or few percent. But it does tell us that stocks are typically insulated from a bear market and large declines. In other words, folks, continue to buy weakness.

Inquiring minds should ask about the credit markets and what they’re saying before asking about leadership.

On Friday we sold PCY, OLED, MHK, some INTC and some RKT.