Bears Get Something To Chew On

Stocks have been on a tear. No sane person could argue against that. Pullbacks have been almost nil since mid-April. And volatility? Well, the VIX has been below 20 for a month, signaling an “easier” time to be invested, even with leverage. Remember, VIX above 30 makes it tough to invest. VIX above 40 makes it really difficult to invest. Above that, well, you can fill in the blank.

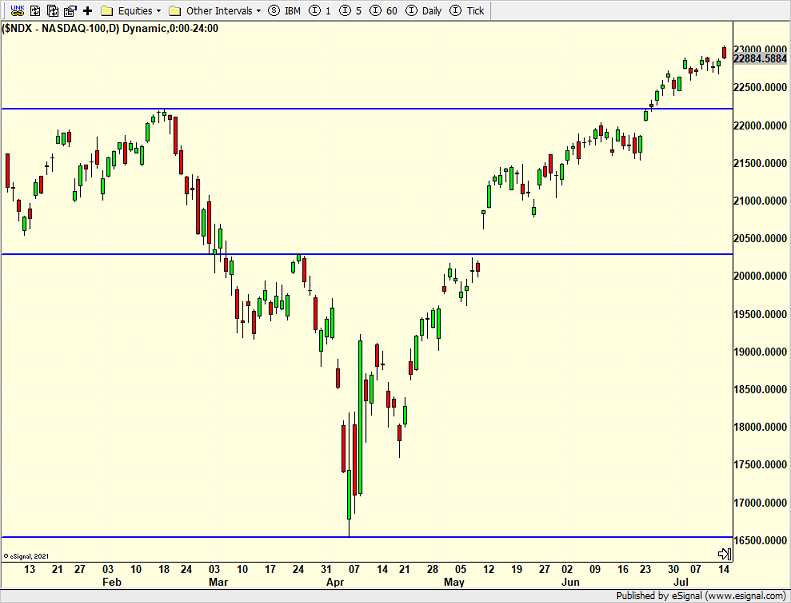

On Tuesday we saw the major stock market indices jump at the open to fresh highs before sellers came in and pushed the indices down to close lower on the day. In technical terms, that is called a key reversal day and can bode poorly for the bulls. However, the bears need to confirm this by having some follow through selling today that closes below Tuesday’s low. I show the S&P 500 and NASDAQ 100 below.

Additionally, one of our main breadth models turned negative for the first time since early February. This effectively downgrades our view on U.S. stocks to neutral and action will be taken today. However, our aggressive models have different rules and algorithms so they will not be impacted by this. It’s too early to offer any downside targets.

On Monday we bought IJT, CRCL and KRE. We sold SSO and some IWN. On Tuesday we bought SSO. We sold ARKK.