Bears Have Tough Few Days – No Stress in Treasury or Junk Markets

Well, well, well, as the pundits and paid actors were advising things like “SELL, SELL, SELL” on Monday, the market did its best to make monkeys out of them once again. I heard one “senior commentator” claim that the late day rally on Monday was just traders “front running” anticipated strength on Tuesday and it was unlikely any rally would hold. Boy does that sound smart. And wrong. In Dow points, the index is now 800 points above that level.

Anyway, we’re all wrong at one point or another and I have many more moments of being wrong ahead. On Wednesday, I wrote about the Textbook Bullish Setup. It doesn’t get any better than that. Hopefully, folks didn’t sell.

Lots of folks have asked if I am sure the final low is in for the year. I am not. While I have high conviction that we will see all-time highs across the board in the stock market in Q4, that scenario can play out several ways.

I do not have the sense that the indices are going to rocket higher from here straight to year-end. I can envision stocks chopping around for a bit and then running to new highs. I can also see another decline into October with a marginal new low below Monday’s low. Whatever path the stock market takes, the bull market isn’t over and new highs should come next quarter which begins next week.

As I have written a number of times, the pullback, all of 4%, felt a whole lot worse to the masses than it actually was. 4% is really just one bad day in the markets. It’s far from damaging or the end of the world. I think it felt so bad because the media and pundits kept pounding the table on these bad pieces of news and how poor seasonality was. Evergrande is the next Lehman. It’s the next Long-Term Capital Management. Folks, it’s not even Continental Illinois.

They should have been focused on market reaction and hard data. As it stands the stock market is roughly where it stood before the week began. If you want to split hairs, it is a few points lower. Monday’s decline apparently scared a lot of investors. They shouldn’t have been.

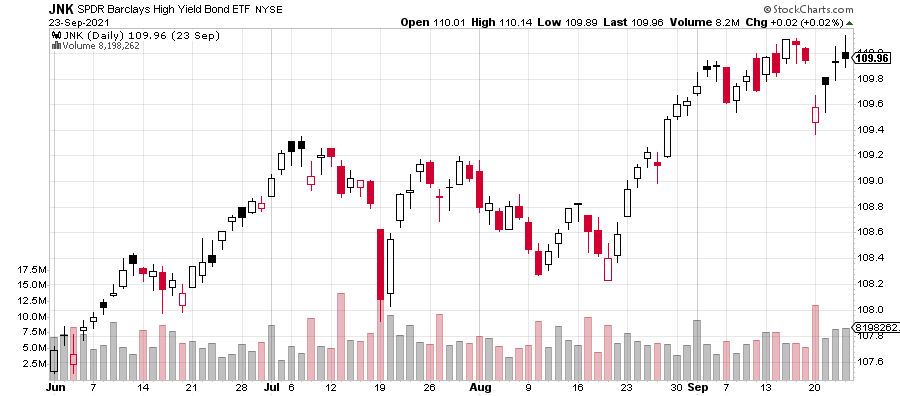

In the credit market, high yield bonds began the week one day from all-time highs and are poised to see blue skies again shortly. If there really was a financial crisis with contagion, junk bonds would have been hit with the ugly stick already.

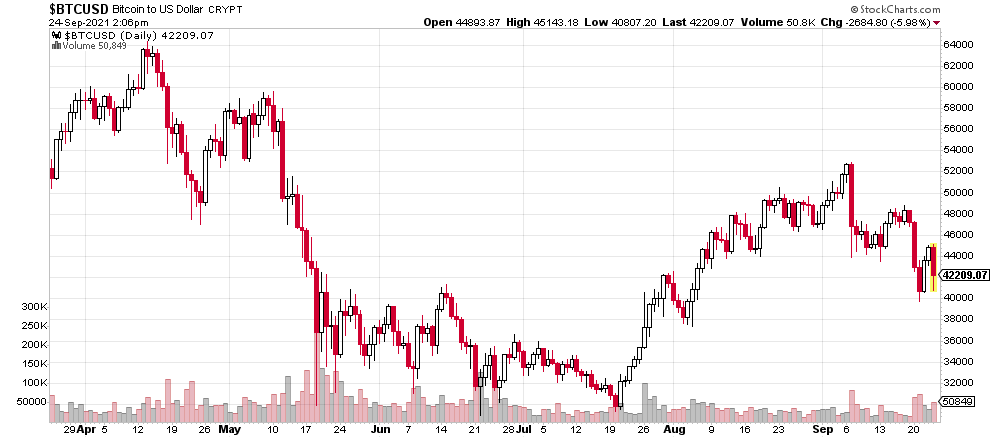

Of course, the crypto crowd was loud (and wrong) as they usually are around perceived events. I can’t tell you how many times I have heard that Bitcoin is a the “new gold” and where the masses will flee anytime there is uncertainty. It doesn’t take an expert chart reader to tell you that Bitcoin (below) is down roughly 20% this month. It will be very interesting, however, to see if Bitcoin exceeds $53,000 or $29,000 first.

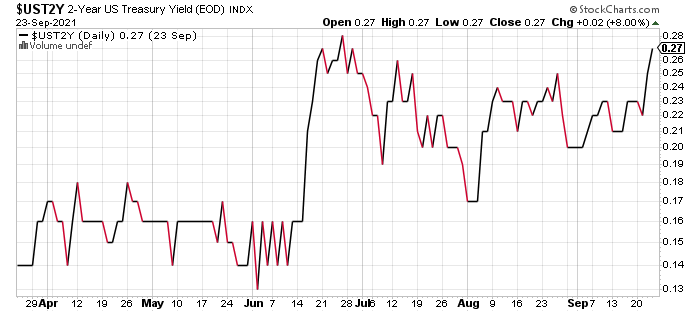

Look at the Treasury market, a clear safe haven in times of stress. The two-year note actually fell this week, meaning investors did the opposite of running to it for safety. Investors sold it and bought risk. Evergrande the next Lehman? Nope.