Bears See Nasty Reversal & Soaring Rates

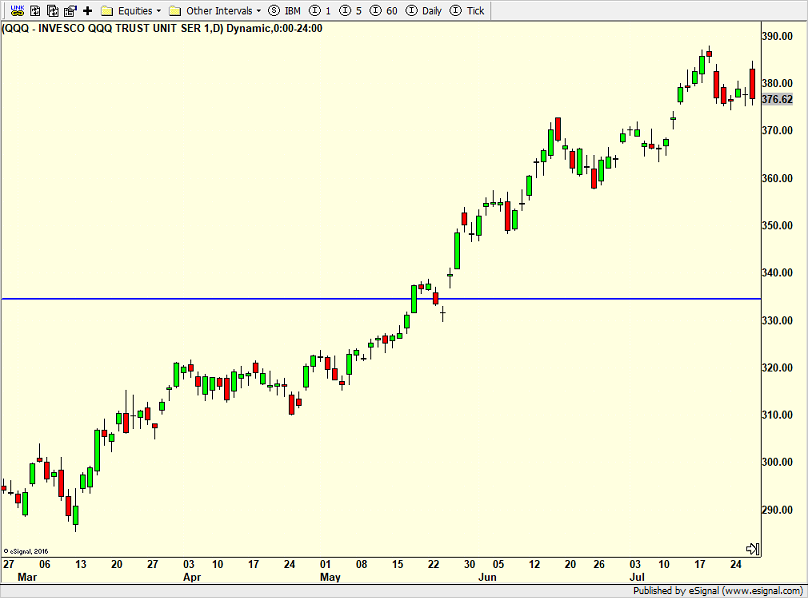

The Fed did exactly what everyone knew they would and for the first time in many meetings, Jay Powell’s press conference was boring and plain vanilla. Stocks did very little which is what the model suggested after the rally muted much of the usual edge. Thursday brought lots of fireworks with stocks ripping higher at the open, only to completely fade by the close. If you asked me at 10am what the odds were of losing that entire gain in the NASDAQ 100 that same day, I would have said extremely low. Yes, I know about the rumors regarding the Japanese altering their yield curve control. It’s always something. The intra-day chart of the QQQ is below.

The bears were out in full force in the afternoon calling for the end of the rally as they usually do during and after reversals. Seriously, they can’t be this stupid or obtuse. I listened to some of them who absolutely required that the October lows be tested before any rally could take hold. Amazingly, some either have amnesia or revised their dour, doom and gloom forecasts. Folks, this is a bull market. No sane person on earth can argue otherwise. Some may not like it. Some may poke holes in it, but bull it is. It may end tomorrow (I doubt it) or in 2024 or in several years, but behavior like we have seen is what you see in bulls. And no, I do not care what economic data the bears cherry pick. Price is always, always, always the final arbiter.

One thing I will say is that the bears are correct that yesterday was a nasty reversal. And they always look scary on a chart as you can see below. But you also need confirmation of the reversal with some follow through. We will see what shakes on Friday, but it doesn’t look promising for the bears in the pre-market.

I have written for a few weeks that the broadening rally has allowed us to move positions away from the big tech winners and into other areas with less volatility and risk. And the final time I wrote about the Dow Industrials getting some love was Houston, We Have Another Liftoff, 10 days ago. I had previously shared our moves into the Dow at the expense of NASDAQ 100.

I’ll tell you what I didn’t see. I did not see the 10-Year yield being this stubbornly elevated. It certainly has the look and feel of wanting to make new highs for 2023 and revisit at least 4.3%. The stock bears will be all over this as the reason to expect catastrophe. A better economy! You can’t make this up. It was recession, recession, recession. Now it’s that rates will crush the rally.

A beautiful weekend is upon us in CT. I have been waiting all summer to hit one of my favorite eateries, The Place, in Guilford. My family has been going since they opened in the early 1970s and I can’t wait to go with friends tonight. Sitting outside on tree stumps, BYOB and amazingly fresh food cooked on a roaring fire. Of course, there will be ice cream for dessert at Ashley’s. Enjoy your weekend!

On Wednesday we bought SLCA, IJS, more DOMO, more TQQQ, more levered NDX and more REPIX. We sold BIIB. On Thursday we bought levered S&P 500. We sold REPIX and some TQQQ.