Bears Still Wrong – 47,000 Up Next

I am planning on a number of timely year-end financial and tax strategy blogs next month. I am always amazed at how few financial advisors do their jobs properly and look out for clients’ best interests as year-end approaches. Now is not the time to get lazy.

The strong pre-Thanksgiving seasonal trend looks to be a bit mitigated this year. The markets remain on solid footing, but we didn’t have any weakness to set it up better.

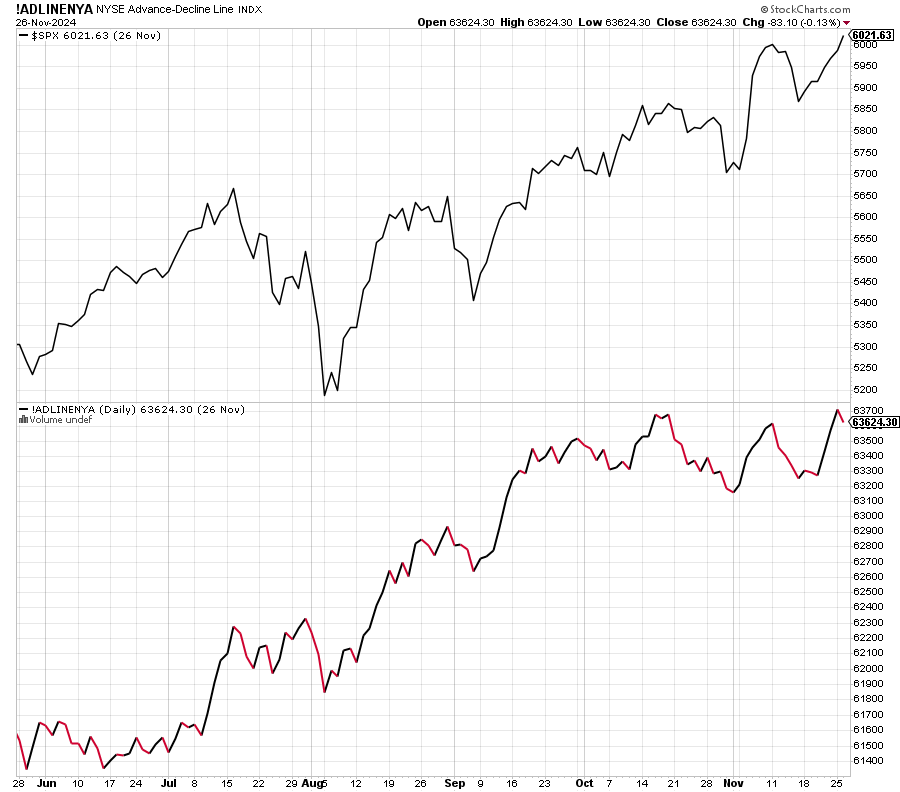

The chart below is a familiar one. The S&P 500 is in the upper box and the NYSE Advance/Decline Line is in the lower box. Forget about the name. The lower box just measures participation. It is supposed to lead or follow the stock market. It is very hard for the bears to argue that the market isn’t well supported with the line at or close to all-time highs. Stick with the theme of buying weakness.

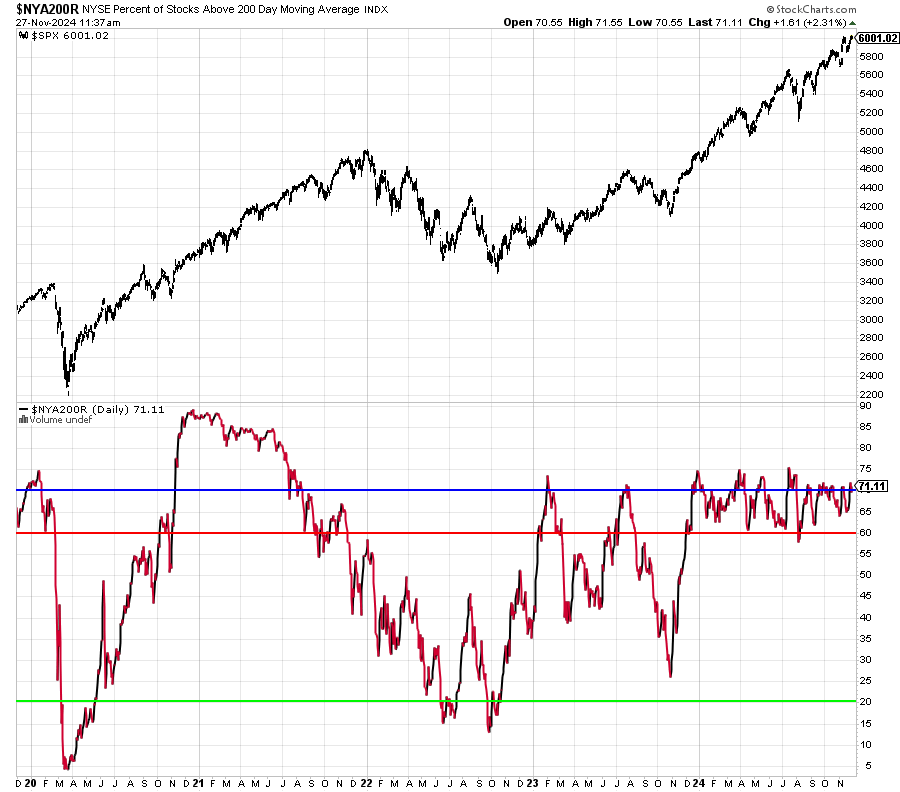

Further supporting the idea of broad participation, let’s look at the chart below. In the lower box you can see the percentage of NYSE stocks in uptrends or bull markets. Bull markets don’t end with 71% of stocks looking strong. Bears lose that argument. Stick with the theme and buy weakness.

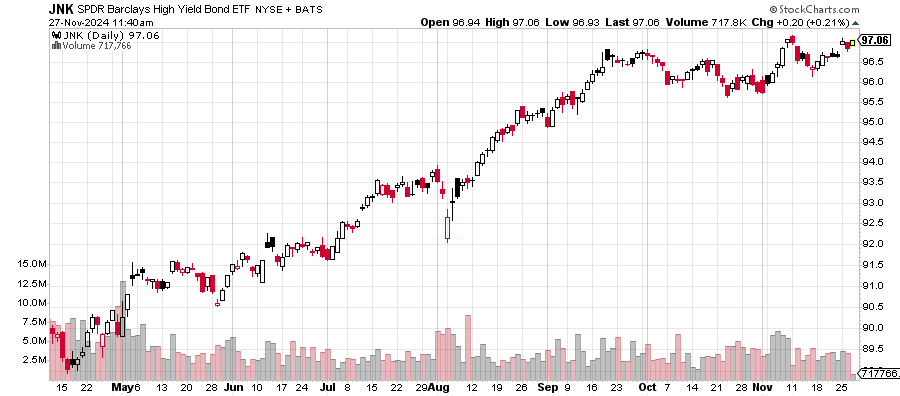

What about my favorite canary in the coal mine, high yield bonds? Let’s look at the junk sector below. Once again, bull markets don’t end with high yield at or close to all-time highs. Bears are wrong again. My next upside projection of 47,000 on the Dow remains in sight for 2025. Stick with the theme of buying weakness.

Don’t get me wrong. All is not hunky dory. I have concerns for 2025. It’s just very difficult to get a real decline going from all-time highs, especially this late in the year.

I don’t know if I will be publishing on Friday. I was hoping to be on snow for day one, but Ma Nature definitely isn’t cooperating. I still may head up north to dump a load of stuff for the season.

For those of you who asked why I only posted pics of food and the coastline, here are a few with real people who were the pros I played with out west. Interestingly, they are all from east!

My favorite holiday is upon us. Longtime readers won’t be surprised to know that I have my routine on Thanksgiving that includes yard work, an incredible amount of food and some adult libations along with binging football. I am so disgusted with my Cowboys that I can’t even say anything nice or optimistic. They flat out stink. They couldn’t win when Dak made $10M a year. I didn’t want him at $45M a year. No shot they can win when he’s making $60M a year. He’s not elite. Anyway, enough of that mess. I wish you and your families a Happy, Peaceful and Meaningful Thanksgiving!

On Monday we bought more ULTA. We sold GDX, NUGT, FFEB, some QQQ, some TEAM, some PM, some PLTR, some TSLA, some WT, some NVDA, some ZM and some WRBY. On Tuesday we bought DWAS, more DXHYX, more IYR, more XMMO and more IYT. We sold some IWF.