Bears Tortured & Decimated

The economy saw more good news on inflation this week with both CPI and PPI coming in a little cooler than expected. I know. I know. You are as surprised as I am (lots of sarcasm). Stocks haven’t rocketed off of the October bear market bottom because inflation was going to remain hot.

The other day I argued with a guy who doesn’t actually manage money professionally, but claims to be all-knowing. We were at odds about the economy and stock market. He sells research and markets “picks”. He claims to have been bearish since the beginning of 2022. Even if he’s being truthful, I asked him how on earth he could remain so negative during a blast off from the October lows and then again after the December pullback.

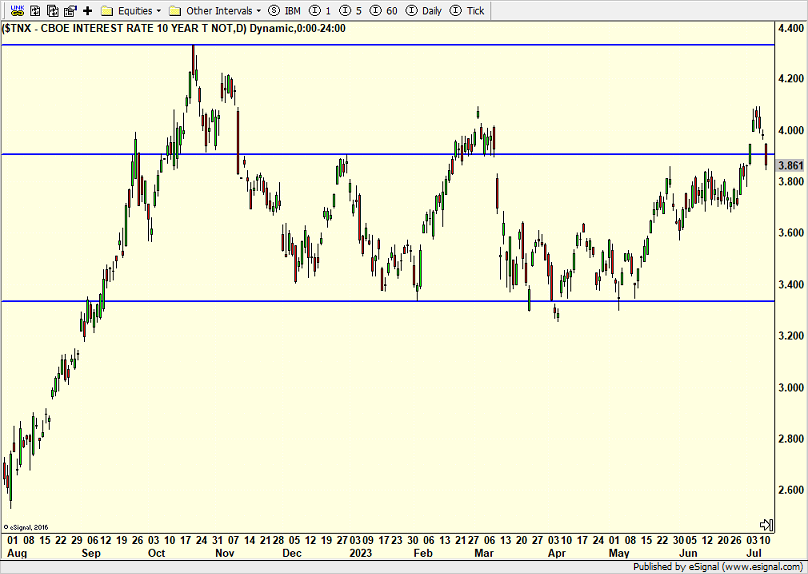

His view was that this is just a bear market bounce. In market history there has never been a rally like this while stocks were in a bear market. In the simplest of terms, just look how long the rally has lasted. It’s 9 months and still going strong. In fact, in some areas it is getting stronger and stronger. The weak economy or recession argument simply does not hold water for 2023. The chart below of the 10-Year does not look like an imminent recession where long-term rates are going down, down, down.

Today I read that Goldman Sachs is now calling for the stock market to hit all-time highs later this year. I literally almost fell out of my chair laughing. I checked my little database and saw that Goldman’s chief guru, David Kostin, forecast a year-end of 4000 on the S&P 500. The S&P is almost 4500 today. While I was checking, I saw so many strategists predicting sub-4000 and only two who predicted the kind of gains I saw coming this year.

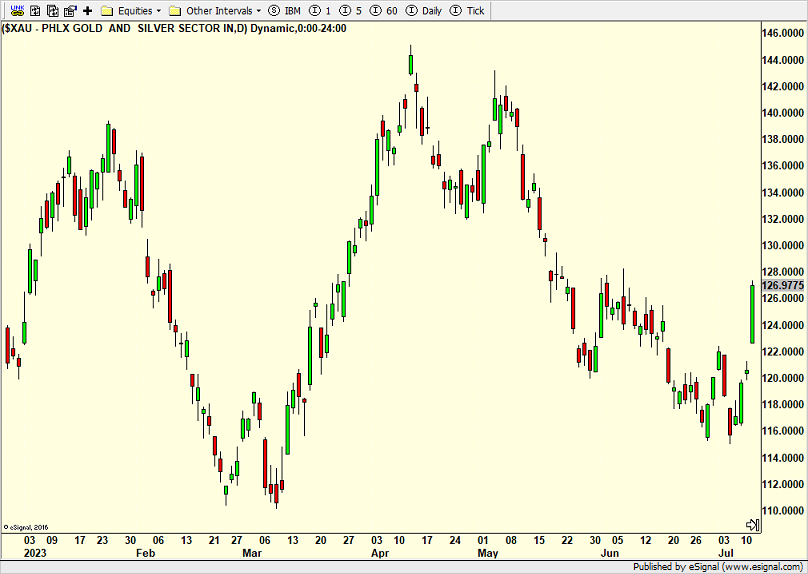

I get asked all the time what I would do right now in the market. I certainly would not throw caution to the wind and go all in on risk assets from the cash position. However, there are also plenty of areas of opportunity. In portfolios that are not aggressive I wrote about our slow move away from the NASDAQ 100 and into other indices like the Dow Industrials as well as small and mid cap value. A few weeks ago I wrote about gold looking really interesting and the possibility for a significant low by the end of June. So far, so good. I like the action as you can see in the two charts below.

In the end we know that the masses came into 2023 very bearish and defensive. And when the three banks were belly up and stocks mildly pulled back, I think a lot of those bears doubled down instead of using the weakness to walk away. Since April, they have been royally up the creek. Jobs are on the line. I learned long ago that the most bullish thing a market can do is go up in the face of bad news.

On Monday we bought KKR, MAS, MCO, ITA and more levered NDX. We sold some SSO and some SAPEX. On Tuesday we bought LABU, AXSPX, HYG, more TGNA, more TQQQ and more RYZAX. On Wednesday we bought PCY, EMB and PGJ. We sold EWW. On Thursday we bought SPYD, JNK and levered inverse S&P 500. We sold SPY, some PDBC and some levered NDX.