Bears Wrong, Again?

On Monday, I wrote about the bulls thwarting the bears with another low forming in the stock market. I also showed some of the fuel that was building up for higher prices in the form of very negative options traders who are usually wrong. Couple that with my Twitter feed turning negative and the bears ostracizing my bullish view, I felt pretty good that stocks would rally. And rally they have in short order, catching the masses off guard.

I tell ya; these perma bears. I can’t believe they have any money left from continuing to hate and disavow the bull market. They continually whine about the markets being manipulated by the Fed and everything being fake. They warn that it’s a house of cards about to crumble. It would be one thing if they just started playing Chicken Little now, but this has been going on for the better part of a decade. Eventually, they will be right and crow about it, but what a joke they have been.

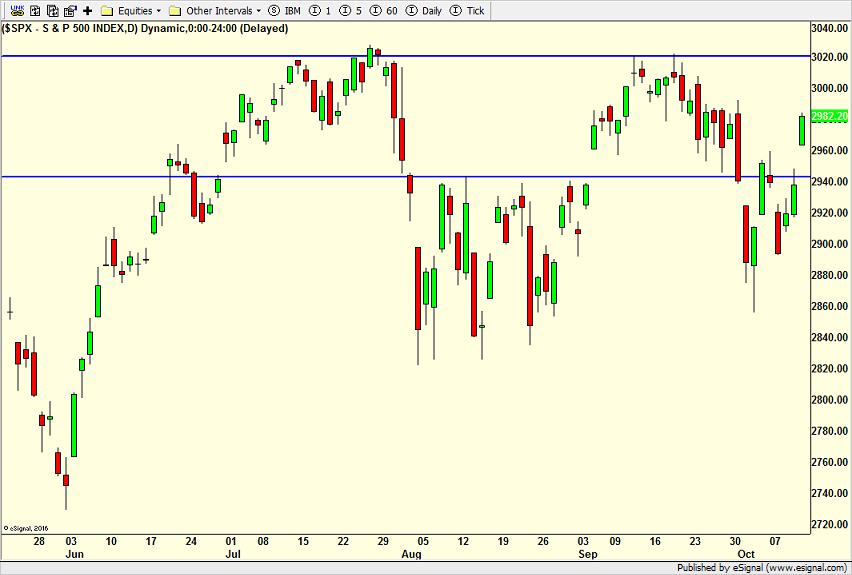

Stocks are back into the middle of the Q3 trading range, but trying to close at their highest levels in October. Whether or not there is one more shot to the downside on a failed trade deal or some tweets from 1600 Pennsylvania Ave, I remain confident that Dow 28,000 is up next with a chance at 30,000 in Q1 2020. The bears just continue to have it wrong. And now, they’re getting nasty about it.

Sector leadership is very slowly and quietly improving. Semis, banks and discretionary are looking better and better. While transports are neutral, they look constructive and could certainly turn more positive later this quarter. High yield bonds are behaving fine and the NYSE Advance/Decline Line is poised for yet another fresh, all-time high sooner than later.

I may sound like a broken record, but use weakness as a buying opportunity until proven otherwise. It’s been an absolute loser’s game to sell weakness.