Behavior Befitting The Dotcom Bubble – Sell The Debt Ceiling News

The stock market continues to exhibit behavior that is really enjoyable if you are in the right indices, sectors and stocks, but not so much fun for the masses who are not. Specifically, the NASDAQ 100, semis, software and other technology at the expense of almost everything else. On the smallest level, it reminds me of the Dotcom Bubble. Yes, that Dotcom Bubble where it didn’t exactly end so well. Astute observers may also recall the inverted yield curve from the late 1990s as well as the Alan Greenspan Fed pumping up the bubble ahead of the Y2K disaster that never happened.

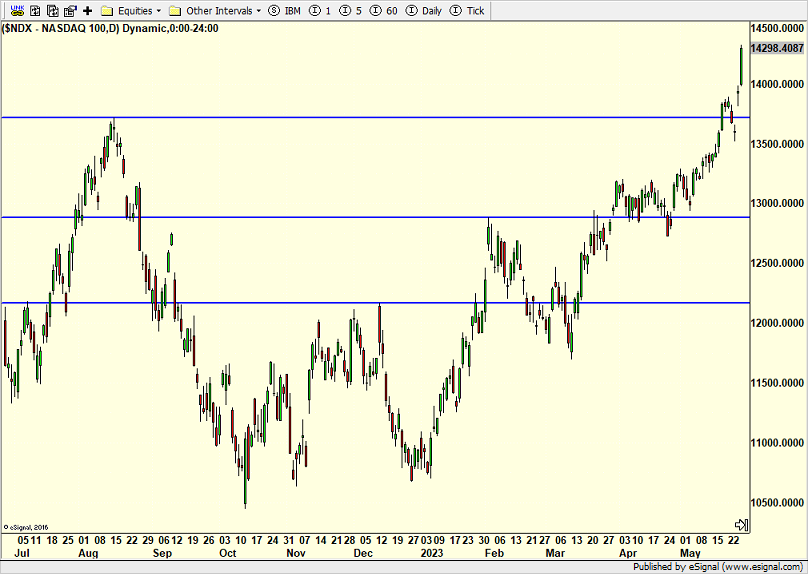

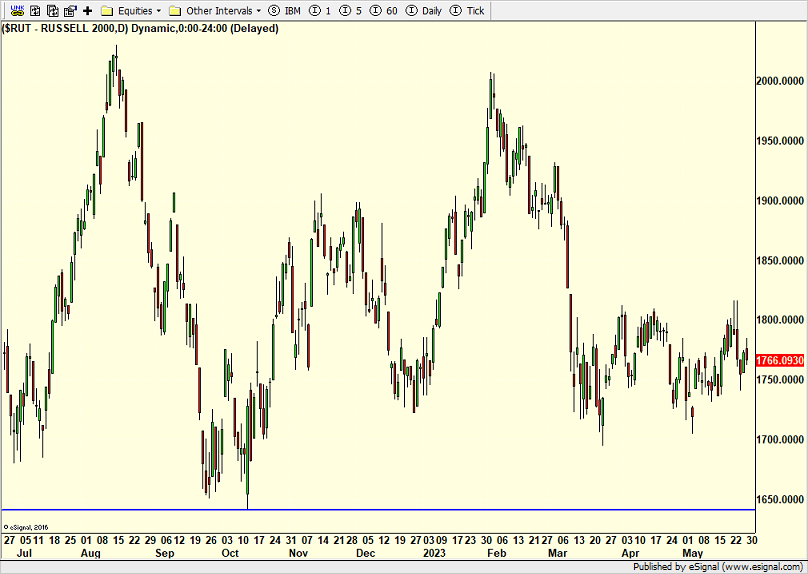

Let me know show you the NASDAQ 100 and the Russell 2000, two indices going in opposite directions. This is not how markets are supposed to behave or usually behave. Nonetheless, we play the hands we are dealt and not the hands we want.

You can see above how well the NASDAQ 100 has done this year and how poorly the Russell has done.

Below is another way to look at this. It is simply the NASDAQ 100 divided by the Russell 2000. You don’t need any special skills to notice that the chart below is going straight up in 2023. It is concerning to me and you know I have been arguably the most positive person on the markets in the industry.

Pivoting to the debt ceiling where a compromise was reached on Friday to almost no one’s surprise, now comes the hard part of whipping up the votes. That should be interesting to watch the far left and far right agree to vote no. Regarding the markets, I view the debt ceiling agreement as more of a selling opportunity than buying one, especially in the indices and sectors that have gone up so much lately. I am not saying that I wouldn’t buy anything here, but I am much more disposed to reduce exposure and/or rotate to some better risk/reward ideas. I spent part of the weekend creating a buy and sell list for the week.

On Wednesday we bought SPHB and FDN. We sold IWF, PPH, RYPMX, levered S&P 500, SSO, HAHIX, HFLAX and WAHYX. On Thursday we bought IJS. We sold SBSW.