Bells May Not Be Ringing But They Are Being Polished

Geez, it only took one day before I got my wish. As you know I have been skeptical that the September 30th bottom would hold having closed on the screws of the low of the day, week, month and quarter. But that didn’t mean the market had to collapse beneath it. And I was concerned that price hadn’t reacted with a surge in volatility as it approached and/or breached the recent lows. Well folks, that all changed on Thursday.

I was looking for a big down opening that was rejected and we sure got that. You can see above that big red plunge when the government released the Producer Price Index at 8:30am on Thursday. Market went from up 300 to down 400 on the Dow Industrials in a matter of minutes. After stocks dove at the 9:30am open, buyers started coming in within a few minutes and ran the stock market from -400 to up almost 1000.

This is definitely not normal behavior, but this kind of action is usually seen during the bottoming process. Again, it’s a process not a point in time. And as you also know I have been crystal clear both here and in the media that midterm election years typically see major bottoms, especially in Q4 and mostly in October, when they has been a significant decline.

One single day will not dictate that, but it just adds to evidence. Additionally, you know one of my favorite adages is that market reaction is more important than the actual news. And don’t forget that the most bullish thing a market can do is go up in the face of bad news. I don’t know if the bells are ringing yet, but they are being polished.

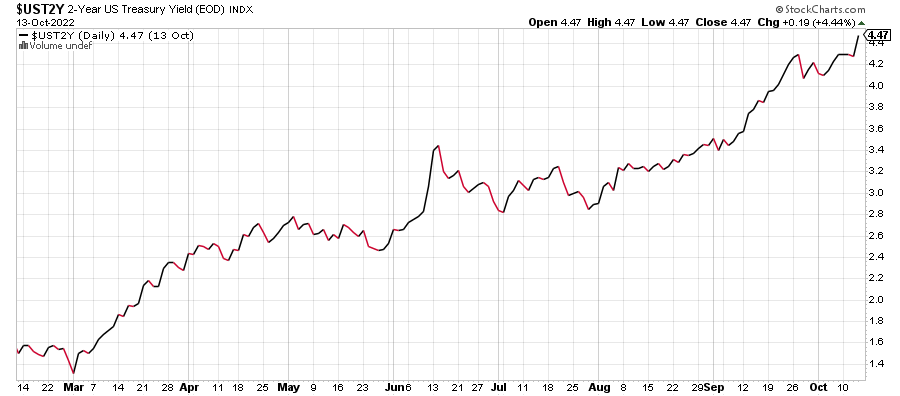

Stock and bond market behavior in the coming days will be important. Thursday’s low must, must, must hold. We need to see the 2-Year Note stop going up and then start to back off.

If the rally continues, we also should see the most beaten down bounce the hardest for now. I literally laugh out loud when hear pundits advise investors to buy “good, solid companies with strong balance sheet, cash flows and dividends” during bear markets. That’s about the worst advice. When bears turn to bulls, the garbage and most beaten down initially rally the most.

This has been a particularly challenging bear market, not because stocks went down; they always fall hard in bears. In 2022 the bond market has been the major villain. In all of history, bonds have never fallen this much and for this long. In past stock bear markets bonds are usually a flight to safety or a haven. Not this time and the average bond investor has been harmed literally like never before.

I will finish with two unpopular but high conviction comments. First, I don’t think the bond market will fully recover for many, many years and prices won’t recover in my lifetime although I do see generational opportunities in bonds right now. And second, the stock market will bottom long before the Fed stops raising rates and long before they pivot. It will also bottom with inflation at stubbornly high levels. All those people thinking they can wait to invest or accept risk until they items are checked off will likely be buying near or above the old all-time highs.

Don’t forget to tax loss harvest, consider a ROTH conversion, add money and confirm your investment objectives and risk tolerance!

I see another busy fall weekend in my plans with Yankees playoff baseball, the little guy’s baseball, golf, a charity event and at least 1/2 day in the office. I am hoping the hydro seeding contractor shows up to hit my summer project and get grass going before everything goes to sleep for the winter.

On Wednesday we bought SPXU and SQQQ. We sold TAN. On Thursday we bought GSG, TUR, IJS, FAS, SPSC, FDVV ad more WIX, more YELP. We sold SQQQ, IJK, levered S&P 500 and some levered NDX.