Berkshire Looking Better – NASDAQ 100 Dipping To Buy

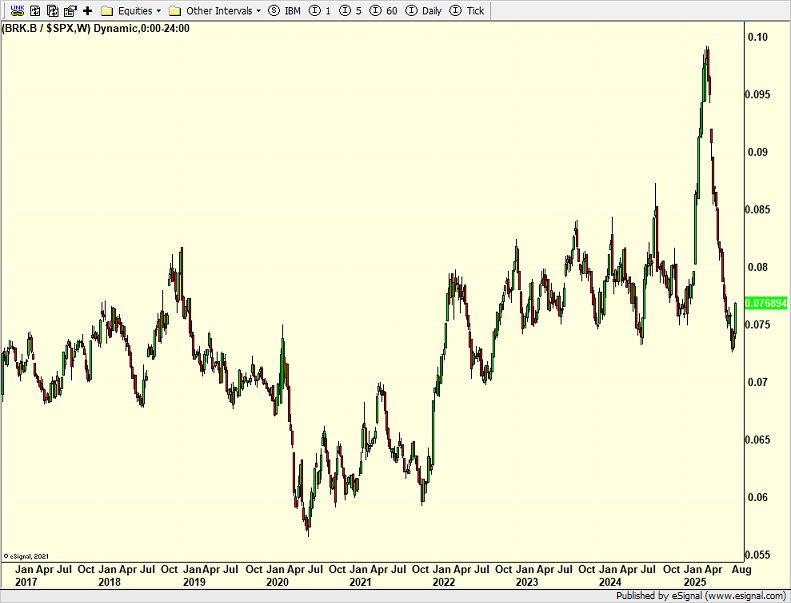

Following up on my Berkshire Hathaway comments from Monday’s post, below are weekly charts of the stock followed by it’s performance versus the S&P 500. Recall that there has been lots of chatter about Buffet’s retirement and the stock no longer being an outperformer.

In absolute terms below, the stocks chart looks powerful, steadily moving from the lower left to the upper right.

Comparing Berkshire to the S&P 500, it’s much noisier. Overall, since 2017, BRK has kept pace to slightly outperforming the stock market. This year, the stock has significantly underperformed.

Looking back to 2001, BRK has handily beaten the S&P 500.

For full disclosure, our Unloved Gems portfolio has owned the stock for many years. I like to prune back when the stock significantly outperforms and buy more when the opposite happens.

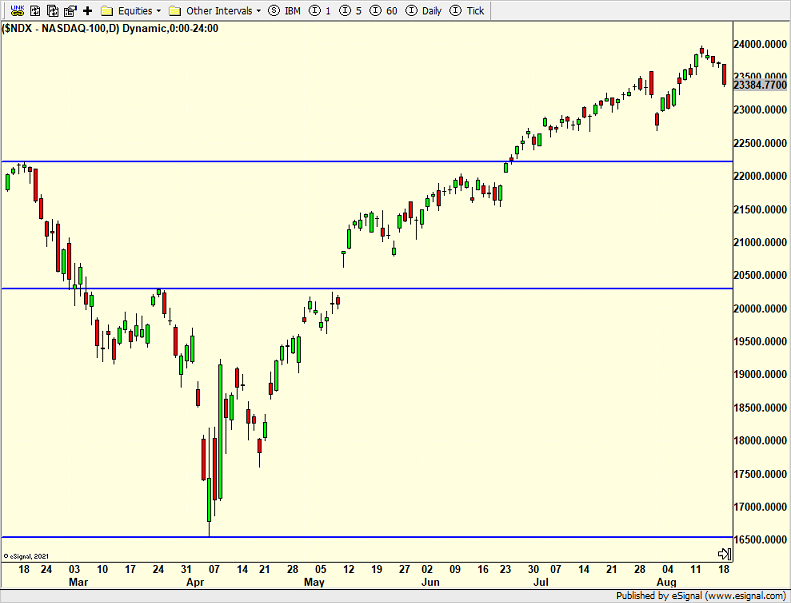

Turning to the the NASDAQ 100, tech and AI, the media seems fascinated that Palantir, Meta and Nvidia have corrected to the point of even transitioning to a bear market. There has been lots of tweets and articles about selling and protecting gains which is not what we usually see before large declines. Rather, pundits and the media pound the table about buying the dip.

The NASDAQ 100 has down four straight days with another down opening coming today. I think risk lies to just below the August lows. I would consider buying weakness from until then.

On Monday we bought GWRE, QMAG, FAUG, SAUG, more QLD, more RAIL, more SII and more COIN.