Boeing, Mueller and Yield Curve, OH MY!

A week ago, I started off my writing that a stronger seasonal headwind was in play for the week, but I didn’t think it would be a significant decline. Stocks did pause overall, pulling back about 1% although it certainly did feel like there was more to it, especially if you watched the various headlines come across with Boeing and the Mueller investigation, BREXIT and the yield curve once again. For a stock market that has risen almost vertically since Christmas, all the news seems to be on the dark side. Doesn’t anyone want to report anything good?!?!

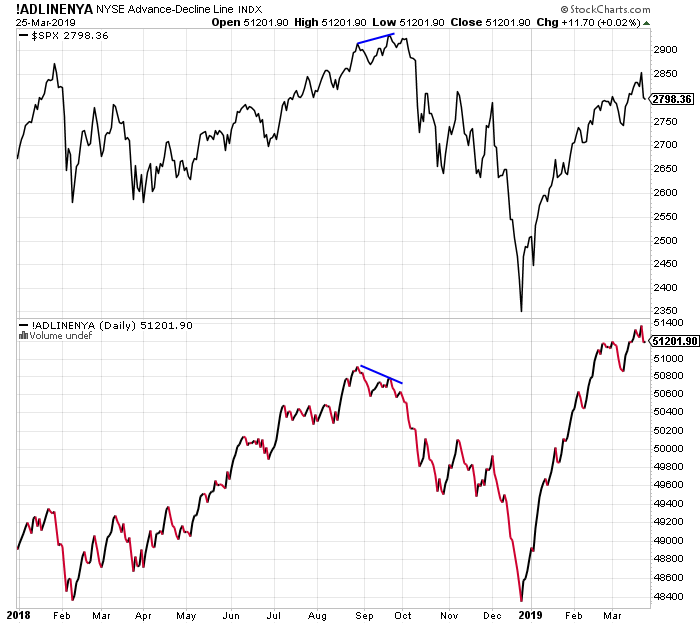

The Dow Industrials, S&P 400 and Russell 2000 have certainly been lagging the S&P 500 and NASDAQ 100. Nothing there to indicate anything worrisome. Semis and discretionary look great while banks and transports stink. A little worry to be had there. Junk bonds have been solid as a rock and the New York Stock Exchange Advance/Decline Line has powered well past its old all-time high.

Seriously folks, how can the bears argue with that behavior? We are seeing widespread participation in this rally as we have since Christmas. I know. I know. They will tell you that it’s all the “bond proxies”. In other words, the NYSE A/D which I show you below is so strong because bonds are rallying and that’s because the economy is heading into recession. Well my friends, the next recession is always coming, but it’s not this week or this month or this quarter. And I don’t think it’s next quarter either.