Bottoming Process Continues with Decreasing Momentum

Last week, I wrote about stocks entering the bottoming process. After a decline of 1100 points in the Dow, there was a possibility that the correction which began on January 26 was ending. The only thing I did not want to see was a large up opening with stocks rallying all day. Well, that’s exactly what happened last Monday. It just prolongs the inevitable.

I still believe that there is a good chance of seeing a 1000 point down day, possibly this week or later in April to flush out the remaining sellers and establish a bottom. Dow 23,000 should be coming sooner than later and I would fully expect the pundits and media to focus their talk on the bull market ending and a new bear market beginning. As I continue to mention, that talk should be premature as stocks should not be done making all-time highs just yet.

As the major stock market indices grope for their final lows, I do not think all five will eclipse their February lows. In particular, the S&P 400 and Russell 2000 appear to be sufficiently strong enough to withstand another bout of selling.

On the sector front, although semiconductors are really taking it on the chin of late and especially since the Facebook revelation, there is a chance that they could stay above their February bottom. The same cannot be said of the banks, discretionary and transports which all seem poised for new lows this month.

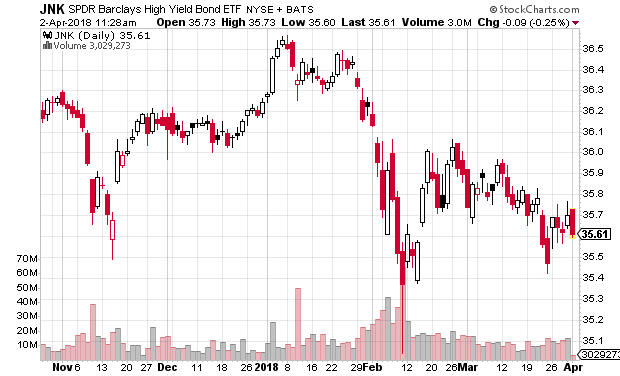

Turning to my favorite canary in the coal mine, high yield bonds, you can see below that junk bonds are hanging in, but by no means are offering any reassuring clues just yet. Let’s see if they can resist this next round of selling in stocks.

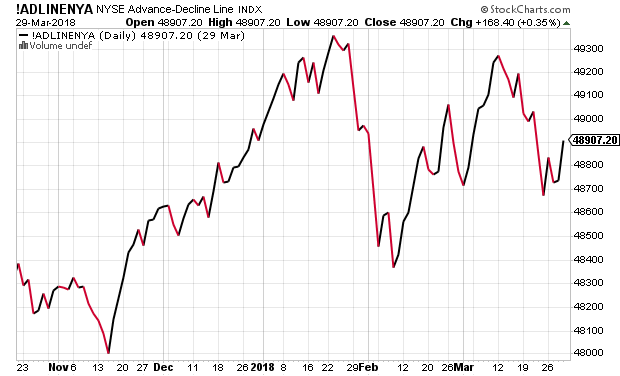

Let’s now take a look at the NYSE Advance/Decline Line which measures participation in the market. With the February lows significantly lower, this indicator is showing less participation as stocks head lower, a positive sign of decreased downside momentum. But just decreased momentum won’t turn the tide.

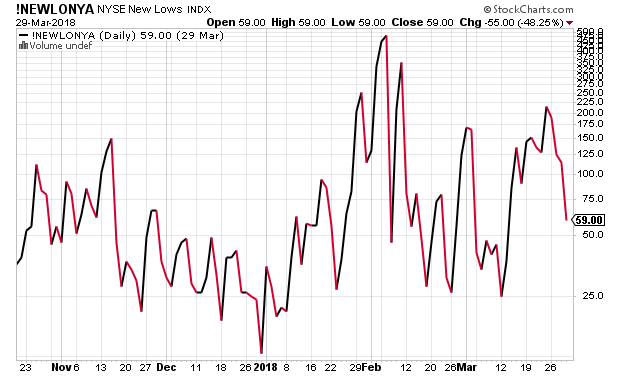

Another measure of downside participation can be seen below. That’s the number of stocks on the New York Stock Exchange making 52 week lows. In other words, how many stocks are at their lowest price level in a year. You can see a big spike in early February to just under 600 stocks. Today, it’s only 59, another positive sign.

As has been the case all year, the volatility Genie is out of her bottle and she normally doesn’t go back in so quickly. Higher volatility was my theme for 2018 and that will continue to play out. I remain steadfast that the bull market is not over and fresh all-time highs are around the corner. It will be that anticipated rally where the opportunity to end the bull market will be.

This morning, China responded to the Trump administration’s tariffs with their own. As I continue to write, no one wins a trade war and this has the potential to end badly economically, especially as the Fed forges ahead with their unprecedented experiment of hiking interest rates and selling assets. Until recently, I haven’t written about recession in many years. Now, it’s on my radar screen for 2019 or 2020.