***Buckle Up Boys & Girls – Special Fed Meeting Update***

The model for today is plus or minus 0.50% until 2pm and then a rally. Given the correction there is extra juice behind the model for post 2pm. Stocks are supposed to rally and I will add the word “strongly”.

Today is the Fed day everyone has been waiting for. The day the Fed finally takes real action to combat inflation and slow down an economy that shrunk by 1.4% in Q1. Yes. You read that right. Jay Powell & Company are going to hike rates by 0.50% today, the biggest hike since May 16, 2000. There’s much to unpack there.

First, the Fed’s rate hike is on the Fed Funds only which filters out to the prime lending rate, credit cards and home equity loans and lines. It has absolutely nothing to do with mortgages and other longer-term interest rates. In fact, those rates have already soared. Remember folks, the Fed follows the markets. The markets do not follow the Fed.

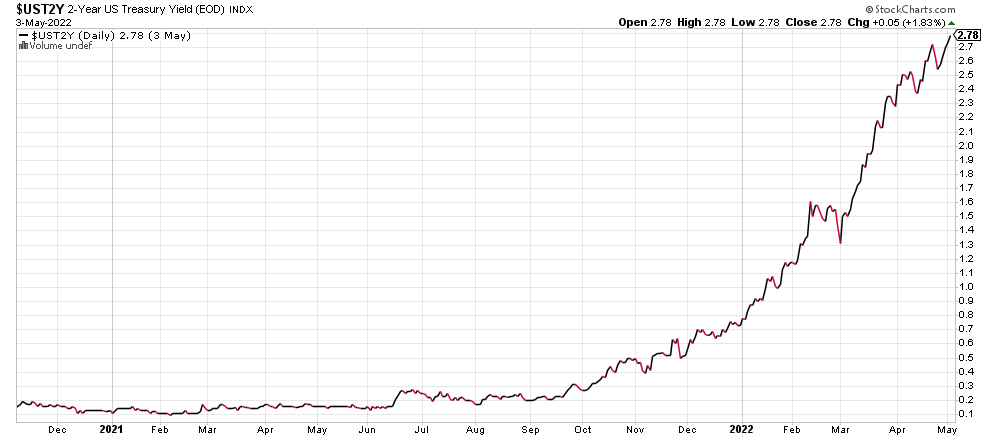

Take a look below at the chart of 2-year treasury note. A year ago it was roughly 0.25% and now it is 2.78%. At the same time the Fed has only raised rates by 0.25%. The market is telling the Fed where interest rates should be right now.

Let’s move on. The Fed is in a hiking cycle to combat inflation. No one argues that. The problem is that they should have started this in Q3 2020 when they had a nice, long and gentle glide path. Yet another major blunder by supposedly the the most brilliant bankers on earth. They are also raising rates because the economy is hot, even though Q1 GDP fell by -1.4%. Yes. I know. It was likely an inventory anomaly. My point is that inflation likely just peaked and the economy is no longer hot. I will add another bold forecast that the unemployment has either already bottomed or will do so this quarter.

So, rates go up by 1/2% today and the market is pricing in another 1/2% hike in June. You have to go all the way back to the tightening cycle in 1994-1995 to find a Fed this aggressive. In 1994 & 1995, Greenspan & Company hiked by 1/2% 5 times ending in February 1995. Although rare I have to give him and them credit because they threaded the needle, landed that 747 on an aircraft carrier, caught lightning in a bottle. They engineered the elusive soft landing. And stocks had the single greatest year in my 32 year career in 1995, surging more than 30%.

For those curious and about to email, hold on. Before you ask how the stock market reacted to Greenspan’s “insane” plan, I will tell you. Three months after each 1/2% hike, the stock market was higher. 6 months after each 1/2% hike, the stock market was higher. And you guessed it, one year after each 1/2% hike in 1994-1995 the stock market was higher by double digits.

IF IF IF Jay Powell & Company engineer another soft landing, I expect the same stock market reaction and a huge rally in 2023. That’s a really big IF. Other 1/2% rate hikes did not have the same bullish results. The one in May 2000 only saw a tepid three-month rally and declines over 6 and 12 months. The Paul Volker led 1/2% rate hikes in the early 1980s were mixed to unkind to the stock market. Of course, back then, we saw a series of rolling mild recessions. Thank you to my friend and data miner extraordinaire, Ryan Detrick of LPL, for compiling these stats.

The key in this period is if the economy can avoid recession. Coming into 2022, I said there would not be a recession and I am sticking by that. 2023 is a different story and it’s too early to make that call.

Let me close with this. In my 2022 Fearless Forecast, I said that the Fed would raise rates less than everyone expected. I still believe that. I think bond yields are in the process of peaking right now and the high will be in place in Q2. Inflation has already peaked. The Fed is going to blink later this year and stop raising rates. The two-year treasury note is going to rollover and meet the Fed Funds Rate on the way down. Short-term interest rates are not going to 3% anytime soon.