Bull Markets Don’t End Like This

Over the past week we have seen two decent signs of the low along with two disappointing signs for the bulls. On Thursday, it became clear that the bulls were just teasing the bears and that the path of least resistance was higher. I was also heartened that one of my primary short-term models turned positive before the July 4th holiday.

From here, I fully expect the S&P 400, Russell 2000 and NASDAQ 100 to score all-time highs this month. I think the S&P 500 will follow suit this quarter. The Dow Industrials have been lagging all year as the Trump tariff tantrum weighs heaviest on that index. I still believe the index will see all-time highs, probably this quarter, and should finally lead if there is any break in the tariff dispute.

While high yield bonds have struggled mightily over the past month, they have perked up a bit over the past week. However, they are back to stinking and remain my biggest concern for the long-term health of the bull market. I do think this canary has died for this cycle.

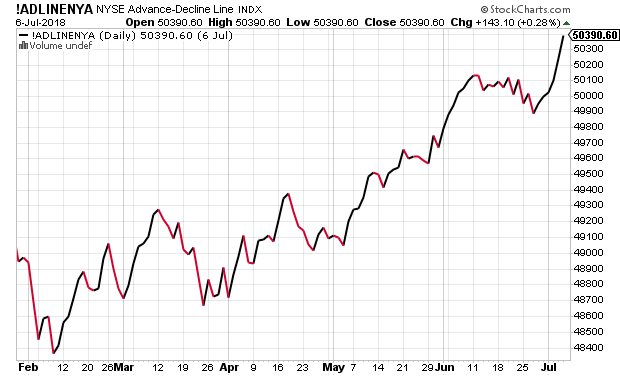

Finally, the best news of the day is that the New York Stock Exchange Advance/Decline Line has surged back to all-time highs, a condition that typically insulates stocks from a bear market, at least 90% of the time. While it’s not foolproof, a 90% accuracy rate is good enough for me. The perma-bears and bear market proponents are barking up the wrong tree, for now.