Bulls Relentless – February Not So Bad – Fed to Hike Rates

I could not have been any more positive as 2023 began against the backdrop of Wall Street looking for a poor Q1 and first half. The stock market continues to behave very well, much to the dismay of the bears which are the majority. And I continue to laugh at their rationale as they hold tightly on to the notion that this is just another bear market rally that is doomed to fail. The market has strong leadership in the major market indices and sectors as well as the strength in high yield bonds. It is inarguable that the NASDAQ 100 which is technology and the Russell 200 which is small caps are leading.

The 2023 rally has been relentless without any pullbacks of more than two days. To be fair, we did see the same behavior in August and that rally ended up failing. If you want to really nitpick you could argue that the August rally failed to clear the commonly watched area of the average price of the last 200 days while the current has done so.

As February begins today, we know that the month typically performs better when it starts in an uptrend like it is doing today. February’s reputation as a bearish month only plays out historically when it is already in a downtrend. It is also the year before an election. I have shared many stats about this year, but I reiterate a few shorter-term ones. January through April are rarely down. The same goes for January through July. And when January closes up so strongly, it mutes the potential downside for February. It’s not as though February cannot be down. It can. However, if it is, the magnitude is likely to be small.

Today is Fed announcement day. For a change, I will not have a diatribe of criticism and disdain. Jay Powell & Co. are going to raise the Fed Funds Rate by 0.25%, but they are not going to officially pivot to neutral. The fact that financial conditions have softened as markets have rallied may keep the Fed heads a bit more cranky today. And even if stocks pullback on the Fed hike, my theme remains the same. Any and all weakness in stocks, bonds and gold can bought until proven otherwise.

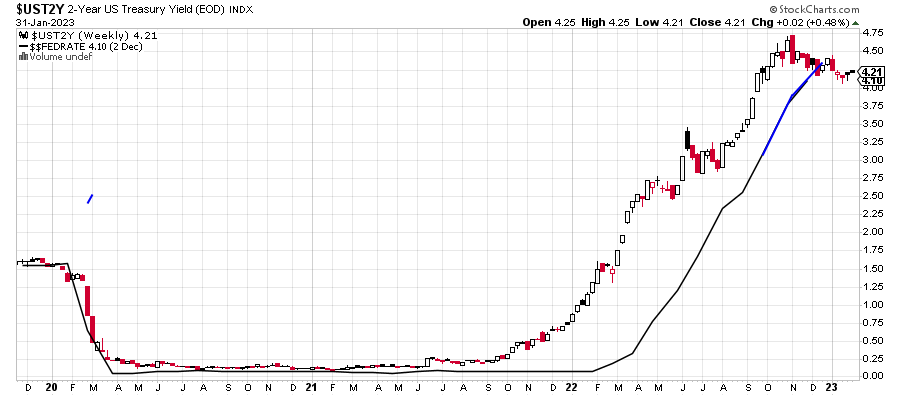

Looking at my favorite Fed-related chart below, for months I have written that we need to see the 2-Year Note cross below the Federal Funds Rate which it did in Q4. After today’s hike, the 2-Year will be even lower than the Fed Funds Rate, signaling the end of rate hikes shortly.

I am amazed at how many people continue to believe the nonsense of “Don’t Fight the Fed.” In 2001 following that advice would have led to a 45% loss. In 2007, that would have led to losses exceeding 50%. The problem with today’s investor is that they’re lazy. Rather than do their own homework, they listen to paid actor pundits on TV who don’t manage real money as professionals. No accountability.

On Friday we sold some levered NDX, some SHV and some XOP. On Monday we bought levered S&P 500. We sold PCY and EMB. On Tuesday we bought more levered NDX.