Bulls In Charge to Begin June But Greed Is Back

Almost every day in January my wife commented how January is the longest month of the year. It’s as if time slows down. The holidays are over and sunlight is at a minimum. She hates when I don’t even bother to lift the shades in the bedroom. I felt like May was an equally long month. The weather was so crummy in CT. It was like March and November.

That all changes as the markets begin June with the bulls in charge. May was a stellar month for the markets as the masses mostly wishing they were fully invested after selling into the tariff tantrum. Data don’t lie. And we saw incredible amounts of selling because folks reacted emotionally to geopolitical events which is about the worst thing anyone can do. It’s a losers game.

Let’s dive into the stats for June. The month closes higher by 0.60% when it begins in an uptrend like today. However, when January through May shows tepid to weak returns, June is down 73% of the time. That’s basically a wash and we are left with a rally that has come very far and very fast against the backdrop of some option trading greed.

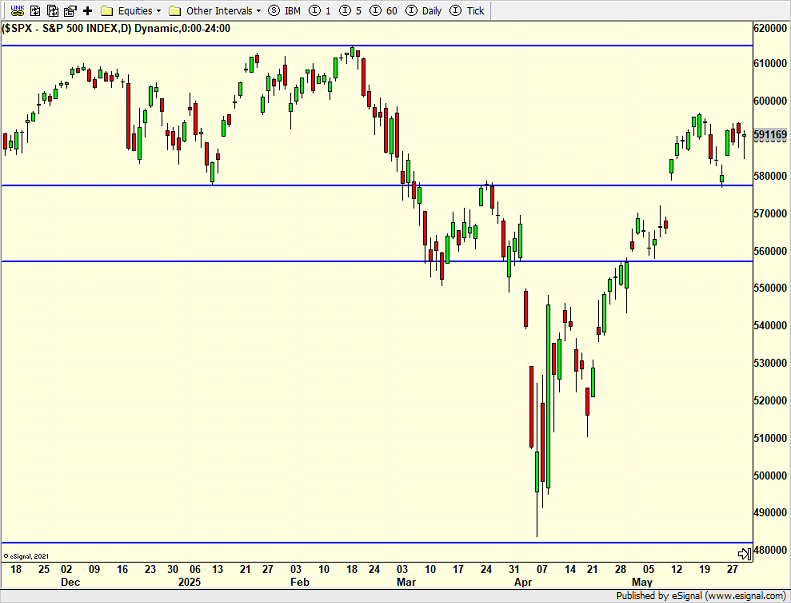

As I mentioned last week, in a perfect world I would like to see the S&P 500 (below) have one more surge to 6000. I think that would set up a pullback this month of 2-5% which would reload the ammunition for a quiet summer rally.

Finally, I am looking for small caps to tip their hand. Let’s see if they can lead for more than a week or two.

On Friday we bought more HYG and more MQQQ. We sold AGG.