Bulls Need Less Momentum As Stocks Correct Lower

The markets continue to be more challenging to maneuver. Friday was the third time and second Friday during the pullback where stocks sold off sharply and then rallied to close well. The previous two times, the bears came right back to work the next day to thwart the bulls. The bulls will absolutely need to break that behavior for any kind of low to form.

Pre-market looks like another ugly morning. And I would speculate that Friday’s lowest point will like be exceeded this morning. That may help to shake out some more traders which will ultimately help to form a low.

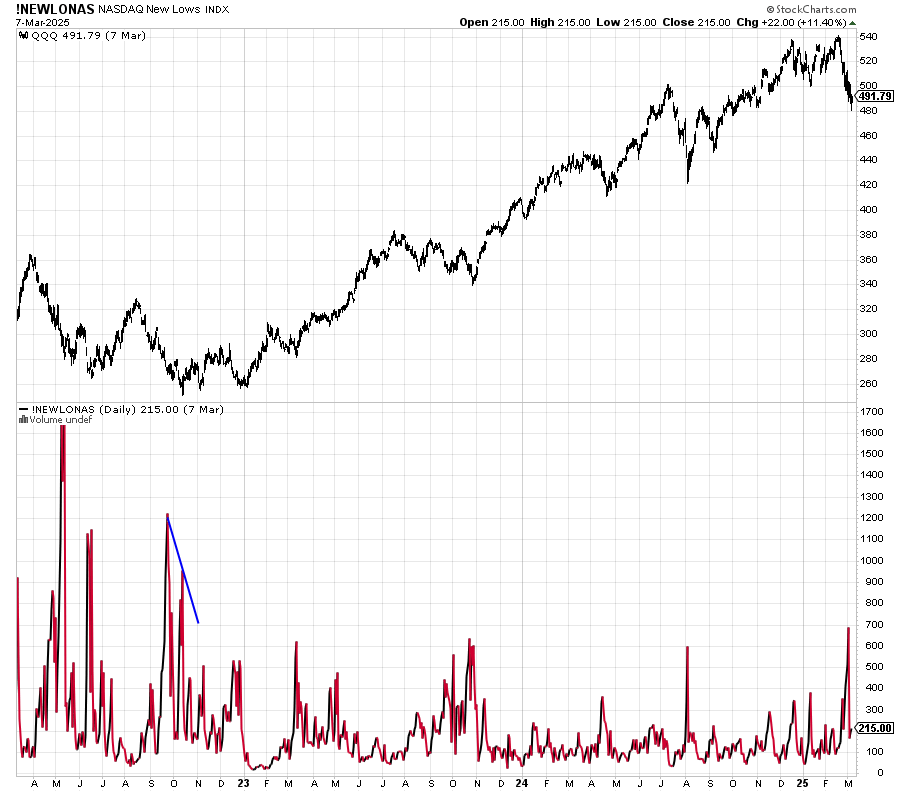

Sometimes, it’s helpful to see if downside momentum is waning to indicate sellers are drying up. Let’s look at the number of stocks making new lows on the NYSE and NASDAQ.

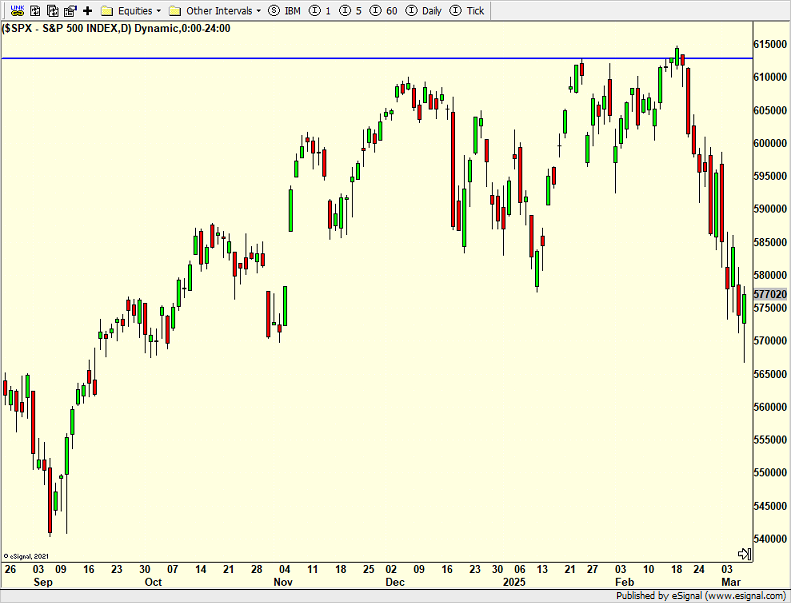

The NYSE is below. S&P 500 is in the upper chart with the number of stocks making new 52-week lows in the lower chart. You can see a small spike in the new lows, but nowhere what it has been in recent history. You can also see that we don’t have a divergence, or less stocks making new lows as the market goes down. That is usually required for the final low.

Let’s turn to the NASDAQ where we see a bigger spike in new lows, but basically the same behavior as the NYSE.

On Friday we bought SPHB, DWAS, WMT, ARKK, more QQQ, BX, SNOW, NVDA and META. We sold XMMO and some FDN.