Bulls Refuse To Cede Control

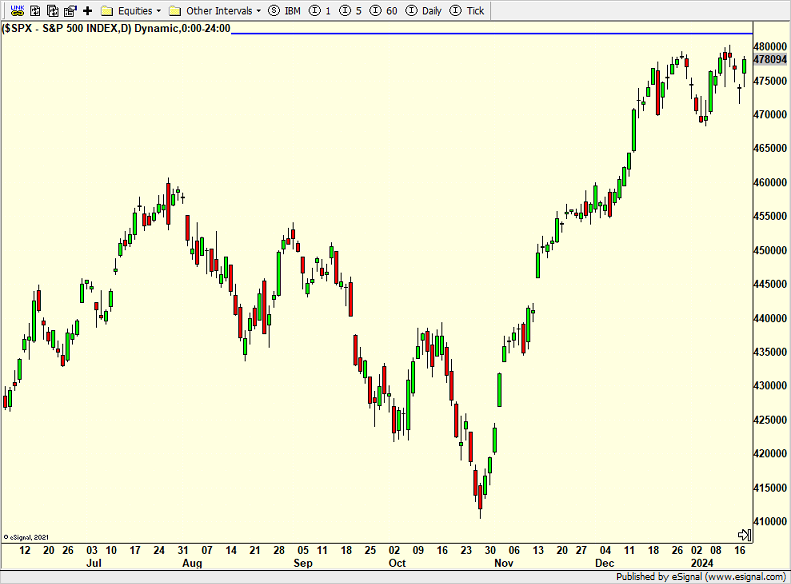

The first three days of this holiday shortened week have been interesting in that the headlines and media have been on the negative side, but stocks are trying to push higher to new highs. The S&P 500 is below and you can see that after Thursday it is once again just one good day from that horizontal blue line which is intra-day new highs. Closing new highs is lower at 4794 which may be seen today. The Dow Industrials and the NASDAQ 100 are in similar positions with the latter scoring fresh all-time highs this week already.

Yet the bears just won’t give up with their “BUT, BUT, BUT”. They are sadly “all in” that the Russell 2000 below has peaked an will lead everything lower with it. I wouldn’t bet on that folks, at least not right here with the current set up and epic upside momentum from Q4.

Interestingly, I am finding so many individual stocks with set ups that are appealing and have excellent risk/reward. That hasn’t been the case in a while and very few of them involve technology which I have been selectively trimming in our Unloved Gems portfolio.

With no more holidays for a month I hope to be back on my regular publishing schedule. I just need to get my Q4 and year-end reports done next week. I know most of you are probably unhappy with the beautiful winter weather we’re having in New England. Snow and cold are my things. But hey, I am cold at 65 or below so it doesn’t really matter if it’s 50 or 40 or -20. I am always cold. And for now, we have real and big snow in Vermont. So thanks Ma Nature, for now.

On Thursday we bought FMAG, TLT, more WEBL and more levered NDX. We sold PCY, EEM, FDEV, DXHYX and some AMD.