Bulls Seizing the Moment – Junk Bonds Not

On Monday I wrote about the Lines in the Sand that were drawn for both bull and bear. On Tuesday we saw the bulls celebrate with a breach to the upside that could not hold until the close. Today, the bulls are testing the upward bounds again, likely with very different results by the time the day ends.

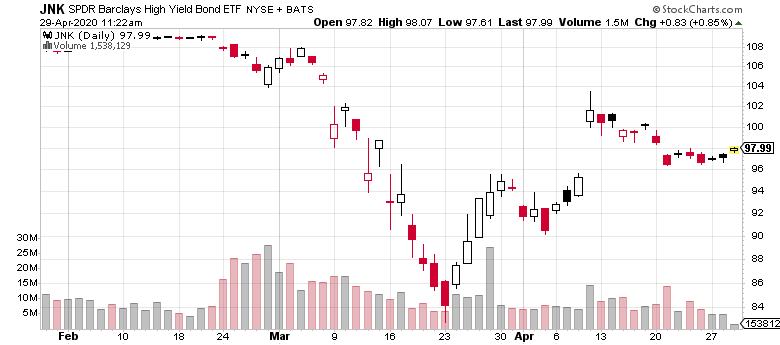

What’s been eating at me lately is high yield bonds as you can see below. They were behaving “fine” until the Fed stepped almost three weeks ago and said they were going to buy junk bonds, something I deemed as outrageous. Since then, junk bonds have only gone down. While volatility has calmed since the announcement, price action has not been bullish. Maybe it’s nothing to worry about because the Fed and Treasury are dominating the markets now. However, I think this canary in the coal mine should be closely watched. It’s odd behavior.