Bulls Should Be In a Buying Mood

Do people realize that the S&P 500 has been down three straight days? That seems like a lot, but the magnitude has been all of -0.50%. Between the holiday-shortened week and Rosh Hashanah, liquidity has been on the low side. That should start to normalize today and certainly next week. I expect the bulls to put money to work at some point on Thursday morning and we will see later today if that sticks.

On the index leadership front, the S&P 500 and NASDAQ 100 continue to behave well and lead the way. That’s not surprising at all given that both indices are dominated by mega cap technology like Apple, Amazon, Google, Facebook, Microsoft and Tesla. I think Microsoft is down 6 straight days, but has lost all of 1%. The S&P 400 mid cap index has done a great job of getting back to the old highs which bodes well for a while, however the Russell 2000 still has some work to do.

On the sector side, semiconductors look better and constructive. Banks have pulled back to an area when they are supposed attract buyers. We shall see. Consumer discretionary is about to score all-time highs. Transports still need help as they look sick.

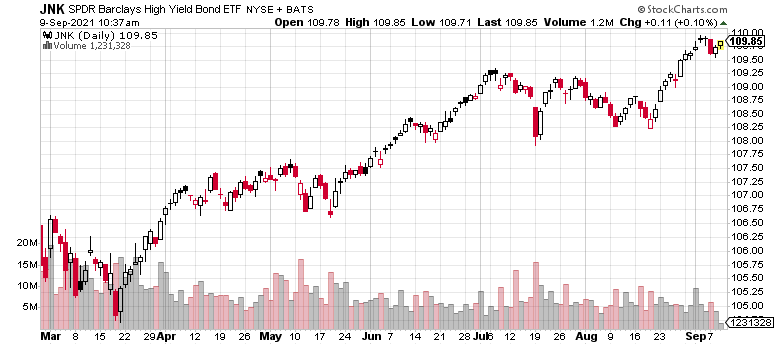

On the credit side, high yield bonds continue to plow ahead like the little engine that could. Without this group rolling over, it is highly unlikely that a major decline or bear market is possible.

Although the pullback has barely been noticeable, the bulls should step in. For months and quarters, the masses have been looking for the “big one” to buy. As you know, when people are looking for something to happen in the markets, it rarely does. We haven’t seen a 5% pullback since October 2020 and I do not believe we are going to see one this month.

Tomorrow or Monday I will discuss the big change in stock market participation along with the buying thrusts we have seen since the August 19 bottom.