Bulls’ Stampede Continues – “BUT BUT BUT”

Stocks continue to creep higher as I have been discussing and as the various studies have suggested. I went back to see when I started mentioning strong seasonal tailwinds. It was at the end of October, coincidentally as the stock market was hammering in a major bottom. Since then with the exception of two weeks in December with seasonal headwinds, there has been study after study all suggesting higher and higher prices into year-end. This has been yet more evidence that the bears have completely ignored as they have been totally impaled by the bulls.

“BUT BUT BUT Paul”, and then you can insert your worries. We heard about runaway inflation, soaring interest rates, another banking crisis, recession, war in Ukraine, war in Israel and war in Taiwan. None of these concerns befell the markets, at least not yet.

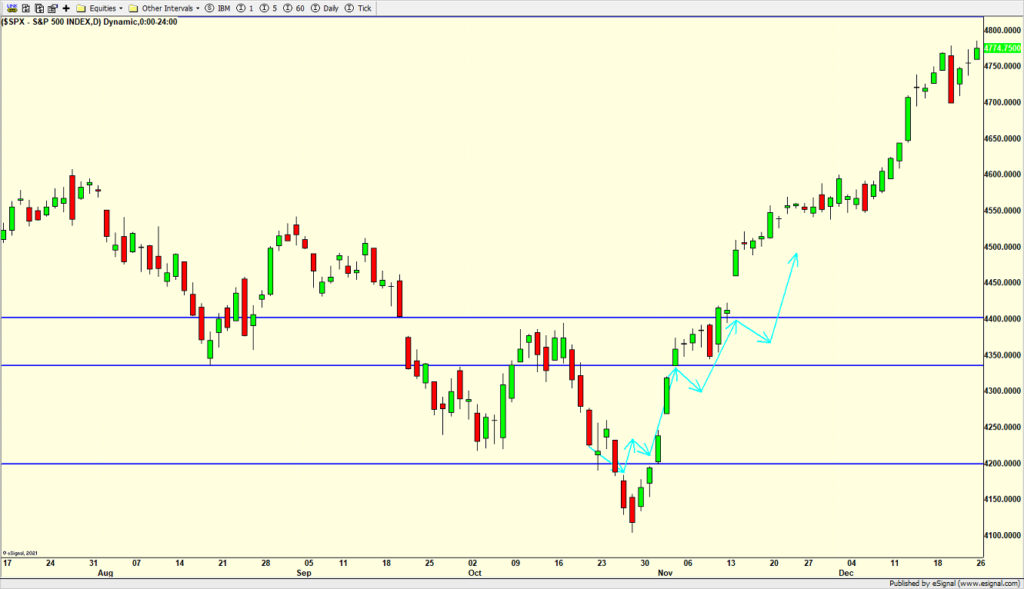

I stopped updating the chart below when it became crystal clear that my scenario in light blue was playing out. And to be fair, the bulls have been stronger than even I thought of late. It’s been one super fun rally since the end of October as we watched professional after professional in a full on panic as 2023 was in the final stages and they were flush with cash or in defensive mode. This has been one of the all-time great performance chases I have seen in my 34 years in business.

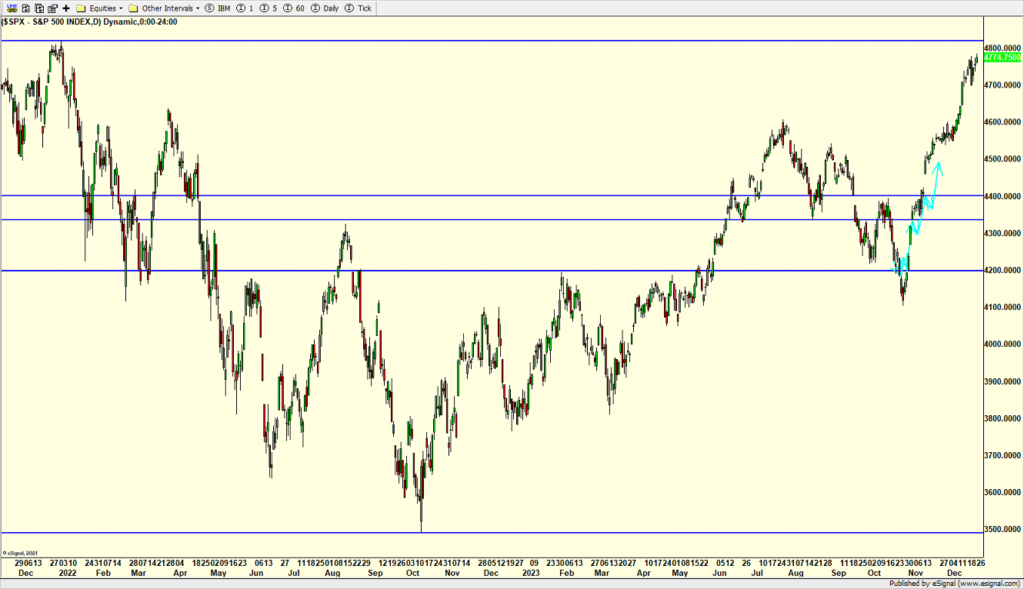

I decided to zoom out and show the last time the S&P 500 scored an all-time high. It was almost exactly two years ago as 2022 began. The index is once again at the doorstep of all-time highs, following the Dow Industrials and NASDAQ 100. While it may pause up here and meander about or mildly pull back, the advance is not over.

On Friday I will have some more fun at the bears’ expense and show the S&P 400 and Russell 2000. The bears have long done the “BUT BUT BUT” with those two indices, but recent action has been hammering the bears hard.

Finally, and just to keep you on your toes, I do see storm clouds brewing in Q1 2024 which begins next week. Now, just because the calendar turns doesn’t mean the markets will pivot on a dime like they did in 2022. I think there is more upside coming. We still have epic momentum and that needs to wear off. But I do see some punishment coming for the late comers.

On Friday we bought more ITB and more BX. We sold some ERX. On Tuesday we sold SPXS, PMPIX, RYPMX.