Bulls Step Up – An Opportunity Worth Playing

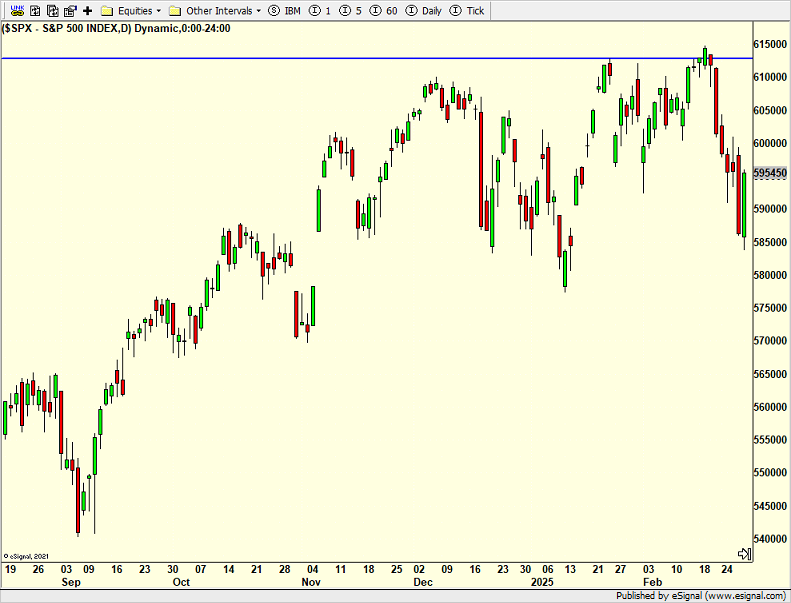

As you know my working thesis has been that the recent mid-single digit pullback is not the 10%+ correction I forecast for 2025. Rather, I thought the Q1 pullback would lead to another rally, new highs or not, that would be followed by the bigger decline.

The bulls stepped up in a big way on Friday as they pushed the markets much higher into the week’s and quarter’s end. Sentiment continues to become less bullish which is good for stocks. However, market internals haven’t declined enough to ring the bell of significant low. Nonetheless, you can see a lot of activity at the end of this post.

Friday was a day to take action, regardless of what happens this week. The S&P 500 is positioned to rally. While I would like to see it go back to new highs to offer another opportunity to reduce exposure and/or risk, the index does not need to get there to satisfy any requirement I have. I have high conviction that there will be one major buying opportunity in 2025. And I think that’s in Q2 or Q3. The one right now would be considered a minor opportunity, but one worth exploring. A close below Friday’s low would invalidate my thesis in the short-term.

As the calendar changed to March we have a few seasonal crosscurrents. March performs better when it begins in an uptrend like today. That leads to an average return above 1%. However, this March also has some long-term cycle negativity with too few instances to be statistically relevant.

On Friday we bought SPMO, XOP, GDX, more UWM, more MQQQ, more QLD, more TSLA, more AAPL and more COIN. We sold TGNA, some XLF, some TAN, some HYG and some IYT.