Bulls Surprising Even Me

The markets had a nice mark up into month-end on Thursday. It was one of those “funny” last 30 minutes when everything suddenly jumped higher as if someone was manipulating it. Surely, that would never happen.

We have the final month of the year beginning today and it is a positive seasonal day. A week ago, I thought the S&P 500 would stop before it hit new highs for 2023, but today, I guess that’s where it’s headed which is okay by me. I like that the unloved 493 stocks in the S&P 500 are getting some love, but I gotta believe that the Super 7 or Elite 8 will have another surge before December ends.

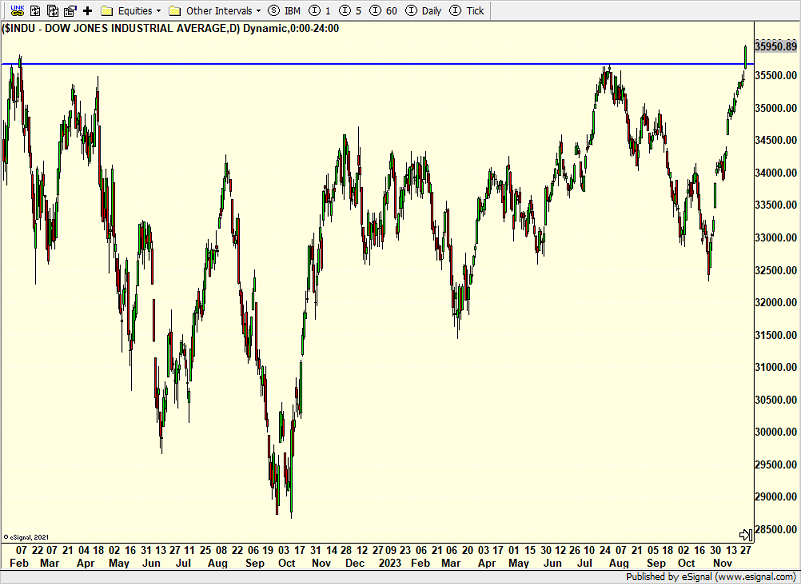

Ya know what’s been strong lately? The Dow Industrials. I think the Dow is at its highest point since late 2021. And I am a little annoyed that we didn’t take a position earlier this week when the stars lined up. The problem I had was that I liked what we owned and didn’t want to sell anything.

Someone emailed about why I haven’t posted much activity across our 18 strategies. I think I mentioned the other day or week that, overall, I like how our portfolios are behaving and there aren’t many new opps at the expense of current positions. I had been looking for the final bottom in October. It came although it did fool me at first. It was atypical. They got me to disbelieve it in real time. Thankfully, that didn’t last. I still can’t get over how many people still hate the stock market. People telling me that CDs are better investments. Um, I don’t think so.

Typical fall weekend in New England is here. And what do you know? It’s going to rain, yet again, even in Vermont. Boo to Ma Nature! That’s not funny nor fair. However, always looking for the silver lining, there are so many great college football championship games and the UCONN men travel to the very hostile Kansas Jayhawks tonight. My expectations are low.

On Wednesday we sold some XLU and some PMPIX. On Thursday we sold levered S&P 500.