Bulls then Bears and Finally Bulls

The stock market had a nice little reversal on Friday as the bulls fended off morning weakness to close well off the lows. While I remain in the pullback camp and see lower prices ahead, the bulls should have enough ammunition to mount a small rally here. If Friday’s lows are closed below anytime this week, I would become slightly more concerned than I already am regarding the short-term, but I don’t think that’s the most likely scenario here.

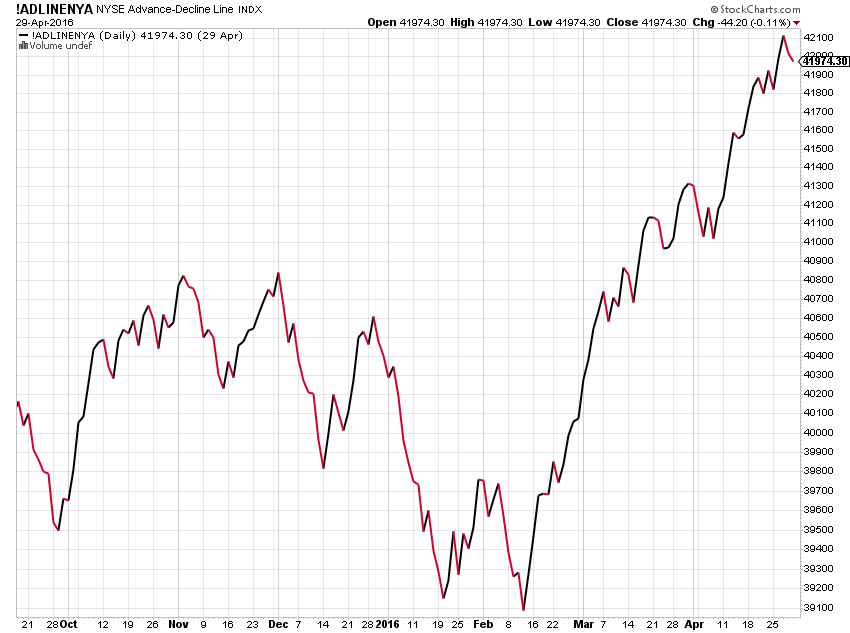

On the sector side, most still look very constructive although semis, healthcare and biotech are the problems. High yield bonds remain strong and the NYSE advance/decline line behaves like a new bull market was just launched as you can see below. For all those perma-bears who continue to wrongly believe that stocks are in a bear market, this one chart below refutes all claims.

All in all, the stock market remains healthy over the intermediate-term, but the short-term risk/reward ratio favors the bears a little. Just your typical, routine and healthy pause to refresh.

If you would like to be notified by email when a new post is made here, please sign up HERE.