BUT BUT BUT For The Bears – Not All Rainbows & Unicorns For The Bulls

I hope everyone survived the cold. I got to visit my favorite bagel place on earth, Ess-a-bagel, twice over the weekend as well as meet and chat with one of my favorite Yankees, Al Leiter.

The markets start the week at all-time highs. Let that sink in for a while. While the bears have doubled and tripled down this year with the nonsensical, BUT BUT BUTs, the bulls have gone about their business after the brief pullback. The Dow Industrials, S&P 500 and NASDAQ 100 are all seeing blue skies right now. The S&P 400 and Russell 2000 still have some work to do although I do believe the former will see all-time highs later this year.

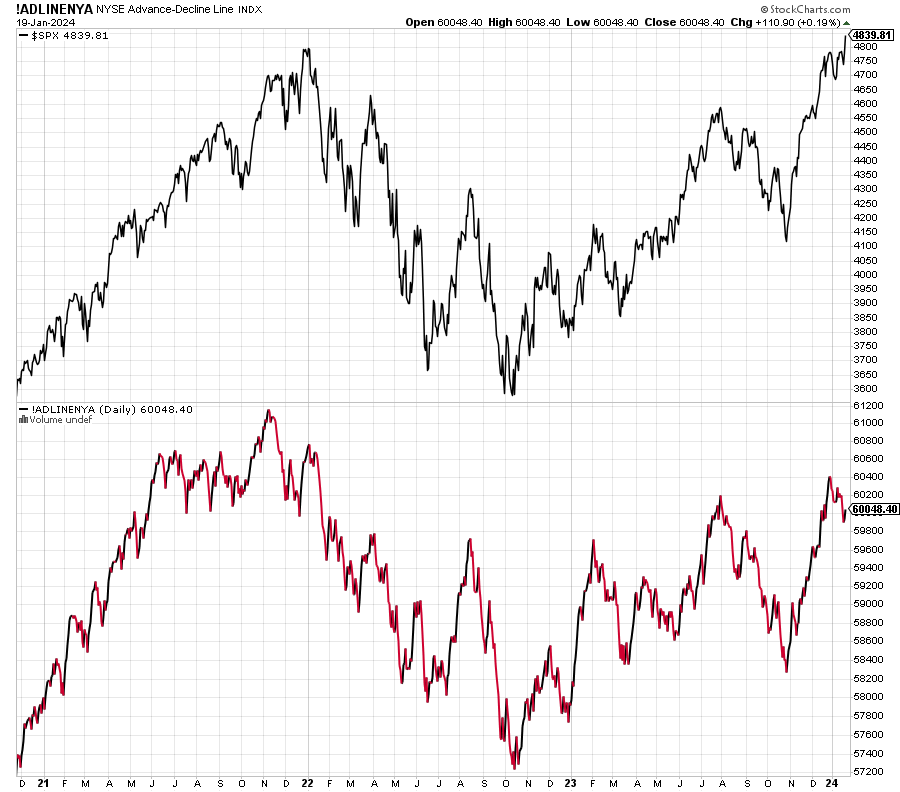

Lest you think everything is rainbows and unicorns, let me be clear; it’s not. The top chart below is the S&P 500. The lower one is the New York Stock Exchange A/D Line which is a fancy name for something that tracks participation in the rally.

Two clear observations. First, on the far right of the chart, while he S&P 500 has just scooted higher, the NYSE A/D Line remains below the level it hit to close 2023. Second, that same line is still well below the level it hit the last time the S&P 500 was at new highs to begin 2022.

Now, before you go screaming into the night with worry and concern, let’s keep in mind that if stocks continue to rally, it is very possible that these non-confirmations or divergences could go away. Let’s keep an eye on them.

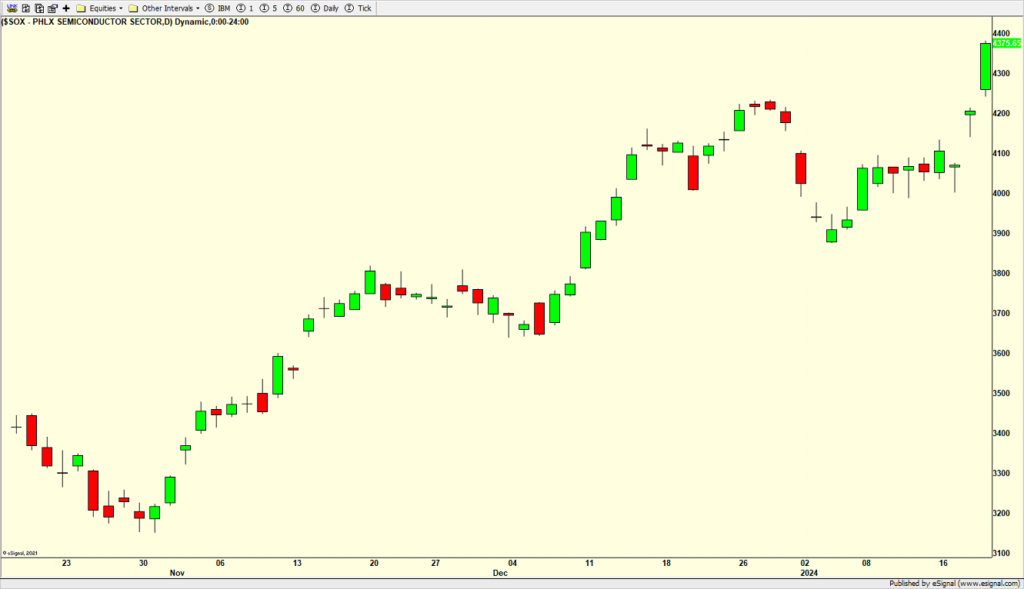

For those who are interested in seasonal trends that I often cite, Friday ended the strongest period for semiconductors of the year. Regardless of anything else, the trend did mighty fine if you bought it October and sold on Friday.

On Friday we bought WBA, SPLV, more IP, more DOW and more BIPIX. We sold EMB, some KAMAX, some SAPEX and some levered NDX.