But It’s Only 6 Stocks & It Looks Like The Dotcom Bubble

With the plethora of news the markets haven’t really gone anywhere lately. It seems like the world is now obsessed with the supposed narrowness of the rally and everyone has become a top down expert in the area. These kinds of divergences can matter tomorrow or in a year. However, the longer they go on, the worse the punishment will ultimately be. Of course, lack of participation can be fixed by, you guessed it, big participation.

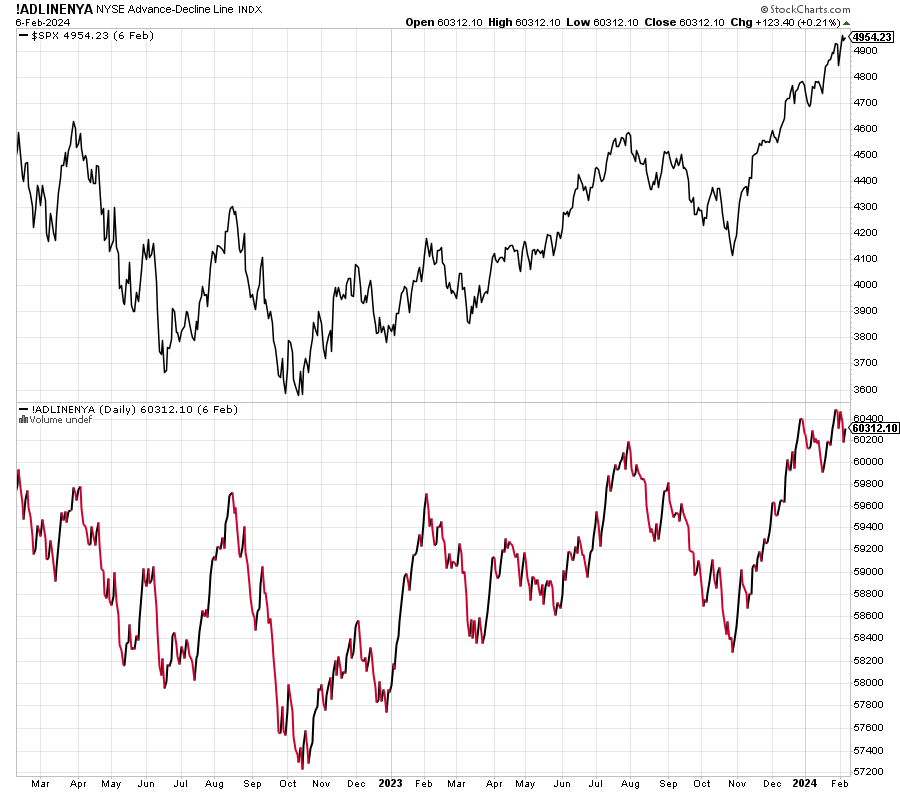

Below is a familiar chart. It simply shows the S&P 500 in the upper chart against the cumulative line of stocks going up and down each day on the NYSE on the lower chart. It’s certainly not as bad as the media and pundits would have you believe.

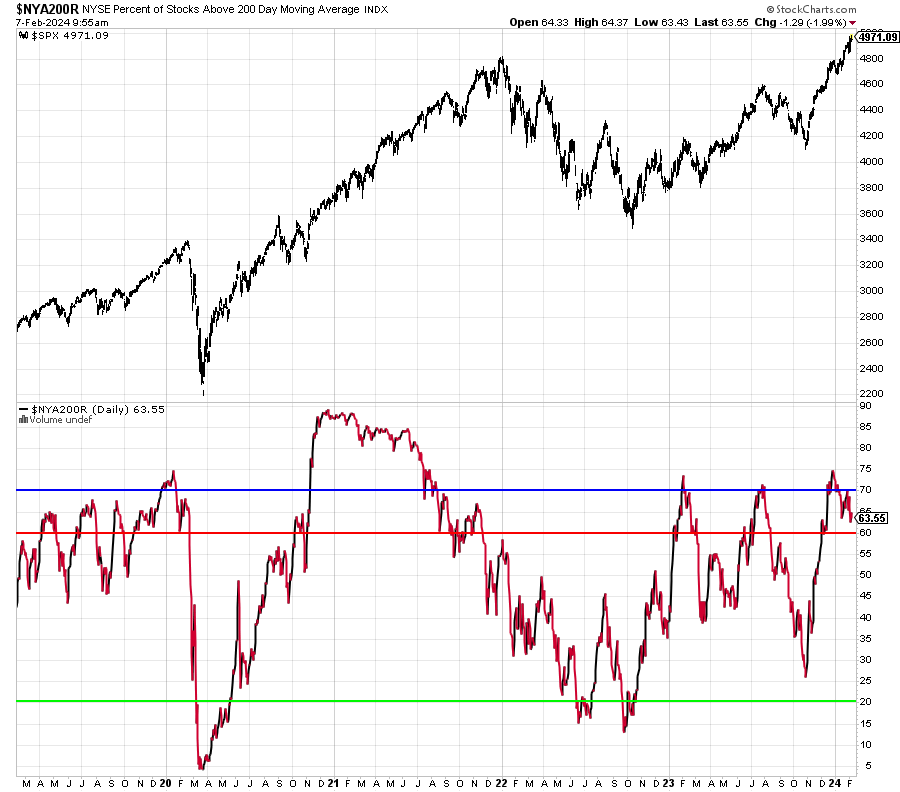

So I am not accused of cherry picking, here is another way to view it, the percent of stocks in uptrends on the NYSE. While it is weaker than the chart above, it’s not weak on an absolute basis. In bull markets you like to see 70% of stocks above their long-term average. It’s just not that difficult to analyze and stay on.

Now that everyone knows about the Elite 8 or Super 7 or Sexy 6, the facts paint a different picture. The bears would have you believe that a tiny group of stocks are the only ones going up and everything else has been decimated. Facts clearly not in evidence. Yes, I agree that on some days, a handful of stocks account for a disproportionate share of the gains.

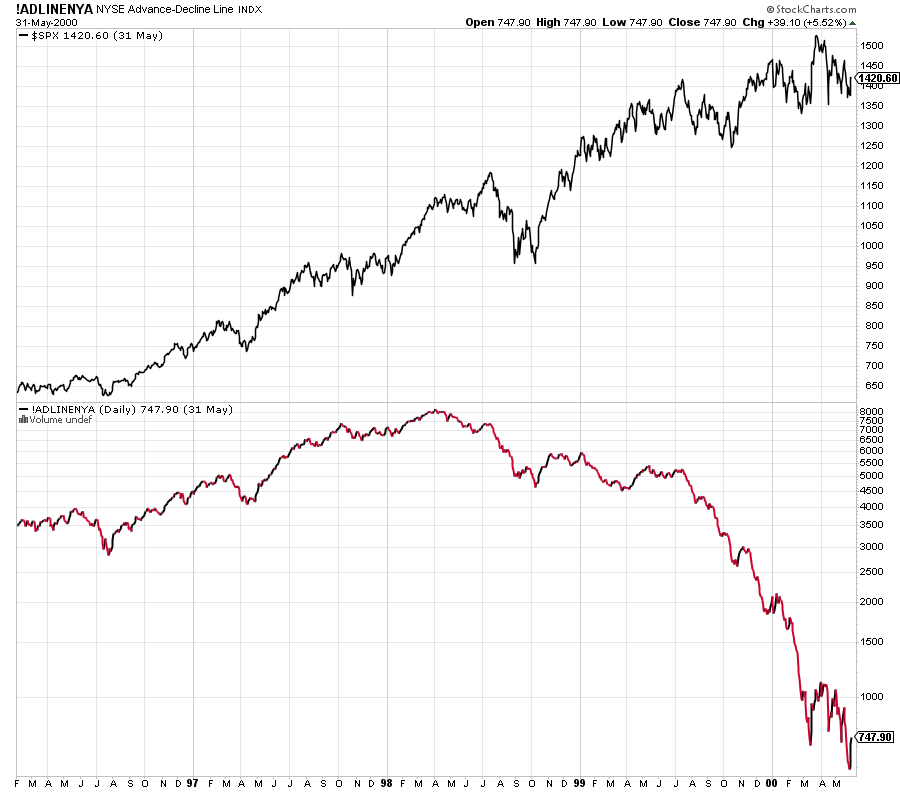

That was the case for most of 1999 and to the Dotcom peak in 2000, but look at how egregious the lack of participation was from mid-1998 to 2000. That looks nothing like today! Pundits should stop invoking the Dotcom Bubble as if the markets were on the precipice of collapse. Chicken Little, Doomsday nonsense at its best.

On Monday we bought small cap value, levered S&P 500 and more RYOIX. We sold IWO, PCY and EMB. On Tuesday we bought PCY, EMB and DXHYX. We sold AVGO and levered S&P 500.