Canaries in the Coal Mine Part II – The Key Sectors

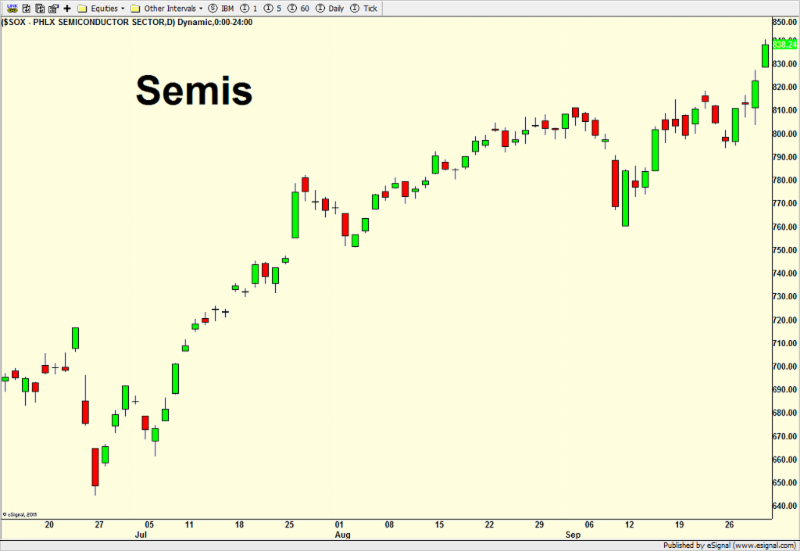

Moving to the four key stock market sectors from the indices I don’t see as strong a sign, but it’s definitely not a weak one yet. The bellwether for technology, semiconductors, is first and you can clearly see a sector that is “large and in charge” or “long and strong” to use some trading desk rhymes. This is very bullish long-term.

Banks are next and contrary to popular belief, rumors of their demise have been greatly exaggerated. Quite simply, the banks do not look bad here and would look outright powerful when they close above their September peak which they are on track to do.

The transports are below and while a longer-term chart would show a sector 20% below its bull market peak from 2014, the here and now looks wound up and ready to break out to the upside. There is sufficient energy built up in this group that could help lead the stock market on its next leg higher to 19,000.

Finally, consumer discretionary is below and I would have to rate it neutral at best. It has some work to do to regain a healthy grade.

The good news for the bulls is that none of the sector canaries are dead or on life support.

If you would like to be notified by email when a new post is made here, please sign up HERE.